Deep dives with the IPEM Community

During IPEM Cannes | Wealth 2025, we asked Private Markets experts from around the globe to share some industry insights by answering a few questions…

IPEM, International Private Equity Market, is the premier relationship broker for global private equity. IPEM Events are world renowned for bringing together the industry’s leading investors, allocators, advisors, and service providers allow to Its dynamic business format is designed to drive innovation and shape the debate across private markets, delivered in a way that champions ESG responsibility. Below are some key insights on megatrends in private debt that came out of our last two events.

Private debt has proven itself in recent years to be a highly resilient, valuable asset class for LPs’ investment portfolios and there are no signs that the party will be coming to an end anytime soon. Overall industry AUM has grown to $1.5 trillion and is forecast to reach $2 trillion by 2027. This is now a mainstream alternative asset class; one that continues to grow and mature as a bona fide megatrend. Indeed, with the opportunity to earn double-digit returns on first-lien debt, industry leaders including Stephen A. Schwarzman believe this is a golden age for the asset class.

There are various factors driving this megatrend. Some of these include, at a very high level:

• Diversification

• Yield enhancement

• Illiquidity premium

• Macro tailwinds

• Income generation

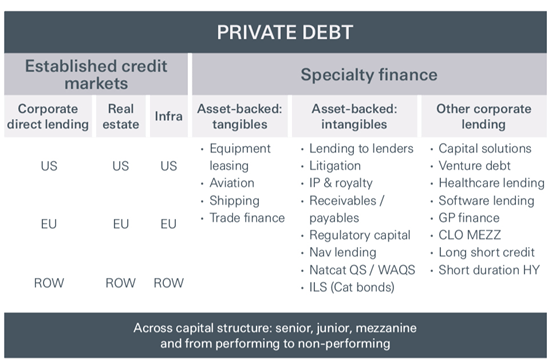

Private debt has evolved to become a highly diverse asset class. Since 2007, the market has grown from $280 billion in assets under management to $1.5 trillion in 2022. While direct lending to corporates, real estate, and infrastructure has been well established for some years, specialty finance has also been growing in areas such as aviation finance, litigation finance, NAV lending, IP & royalties, and venture debt. Indeed, KKR estimates that asset-backed finance is a $5 trillion market and growing.

Figure: The private debt landscape extends over a broad range of strategies, collateral types, regions and levels of seniority

Sources: StepStone Group and GIC, as of June 2023

With successive rounds of interest rate hikes by central banks over the last two years, private debt funds have been licking their lips, eager to underwrite senior secured loans which in Europe are floating rate. These rate hikes have happened while, simultaneously, banks have retreated from the broadly syndicated loan market, pushing companies (and PE sponsors) to seek out alternative finance options; both to fund ongoing M&A activities and LBOs.

The floating rate nature of European private debt means that if default rates were at risk of spiking higher, they would arguably have already done so. That they haven’t is a sign of how resilient the asset class is. Industry participants expect default rates to stay low. Also, one key merit of unitranche loans, which combine senior and subordinated debt with a blended interest rate, is that they have a first lien component that provides protection, should companies get into cash flow difficulties.

Although it still lags behind the US, private debt growth in Europe continues to be strong. Today, approximately 60% of loans originate from institutional funds, and 40% are via traditional bank loans; this compares to roughly 80/20 institutional/bank-led financing in the US. Countries like the UK and France are leading the European charge, and while corporate direct lending is the biggest sub-asset class, real estate and infrastructure debt continue to evolve.

Since Q4 2012, 77 leading European alternative lenders have completed over 4,400 deals. What you now have in Europe is a virtuous cycle. Capacity is rising, along with the size of direct lending funds, as more borrowers turn to private debt and more LPs look to invest in the asset class. Indeed, the fact that new investors are coming into the market is another key reason why the private debt megatrend continues to develop.

Regarding deal size, it is now not uncommon to see unitranche deals of $4 billion to $5 billion in the US and deals of EUR1 billion to EUR1.5 billion in Europe. During IPEM’s private credit summit sessions, both during IPEM Paris 2023 and IPEM Cannes 2024, industry experts, while enthusiastic about bigger deal opportunities, urged a degree of caution. When you get to a situation where 10 or 15 direct lenders are all participating to finance a $10 billion deal, for example, that is not a good trend. That is the start of a privately syndicated loan market and not the original value proposition that LPs have signed up for. They want GPs to pick credit opportunities, apply their underwriting expertise, and manage the asset as the sole lender. That’s what they are paying for.

ESG margin ratchets can be important to companies as they look to improve their ESG credentials, and LPs become more demanding on climate-related risks, asking for more information from private debt GPs.

One of the biggest drivers for private debt managers using ratchets is the impact on valuation upon exit. Analysis shows that on exit, 1 to 2x turns of EBITDA of additional valuation is achievable if the company is ESG-compliant and has a credible pathway.

How the use of ratchets will unfold will, to some extent, depend on whether companies are sufficiently motivated by the size of the ratchets. Some GPs are creating internal advisory groups to work with portfolio companies. If valuation is the main lever at the point of refinancing a loan, or because the sponsor is looking to sell, GPs will look to rely on accreditation labels that will hold value with the new buyer; for example, the Building Research Establishment Environmental Assessment Method (BREEAM) used in real estate.

Globally, private credit is expected to remain appealing, regardless of the level of refinancing rates.

Still, there is no denying that scale and fundraising opportunities will continue to develop. Some private lenders will continue to grow and dominate the market in a ‘winner takes all’ scenario, which could lead to consolidation as the big get bigger. This has already happened in private equity, where you have megafunds on one end of the spectrum and niche, mid-market funds on the other end. This is expected to happen in private credit but it doesn’t mean GPs will have to lose their personal touch. There will still be scope to provide a tailored approach to financing the needs of companies.

Sponsor-led private debt is around $1.5 trillion, of which around $220 billion of that is in Europe. In both Europe and the US, spreads have moved out to the mid-600s, with significantly lower leverage. When the broadly syndicated markets re-open, some industry experts expect a bit of steam to leave the larger end of the direct lending space. Spreads are expected to contract beyond 2024.

Even though direct lending has enjoyed a purple patch in recent times, the world has changed. Deals that were inked in 2021, for example, with higher leverage, could face a moment of truth in the next 24 months, as companies have to refinance.

Speaking at IPEM Paris 2023, Adam Wheeler, Co-Head of Global Private Finance, Barings, made the point that increased manager divergence might well be seen in the next two years. Listen below in the following clip:

As was noted during Wheeler’s panel discussion “How is private debt positioned to outperform?”, margin compression is potentially coming into the system. Faced with higher rates, companies with 3x debt/EBITDA should be able to navigate these elevated financing costs but those with 5x or 6x debt/EBITDA could well start to face pressure.

Wheeler’s panelists included: Laura Scolan, Head of France, Private Debt, Tikehau Capital; Gregory Racz, President and Co-founder, MGG Investment Group and Edouard Narboux, Managing Director, Aether Financial Services.

The private debt megatrend is evidence of just how important an asset class it has become. Factors like bigger deal sizes, bank retrenchment, higher interest rates, and decarbonization are all contributing to continued growth. As more investors begin to understand the value proposition and new investors come into the marketplace, there are plenty of reasons to suggest that the future of European private debt looks strong.

At IPEM we bring together the leading names in private debt, to ensure delegates are getting to the very heart of the issues shaping this key asset class.

Hear from institutions that over the last 12 months have included: Ardian, KKR, Tikehau Capital, HPS Investment Partners, Cheyne Capital, Pantheon, MGG Investment Group, Aether Financial Services, and BNP Paribas.

If you weren’t able to attend the last two editions of IPEM, don’t worry. We will be continuing to forge ahead and debate the key issues shaping private debt at our upcoming IPEM Events.

During IPEM Cannes | Wealth 2025, we asked Private Markets experts from around the globe to share some industry insights by answering a few questions…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to watch the Infrastructure Summit Replay.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to watch the Private Debt Summit Replay.

Fill in the information below to watch the Webinar Replay.

Fill in the information below to download the LP Package.

Fill in the information below to watch the Climate Investing Summit Replay.

Fill in the information below to download the Factsheet.

Fill in the information below to hear the full podcast.

Fill in the information below to hear the full podcast.

Fill in the information below to hear the full podcast.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to watch the Venture & Growth Summit Replay.

Fill in the information below to watch the Impact Summit Replay.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.