IPEM Paris 2023 – The Daily Spin – September, 20th

IPEM Paris 2023 – The Daily Spin, September 20th

The key questions surrounding private market performance will be covered in detail, and should spark plenty of debate among institutional investors during Day 2 of IPEM Paris 2023, 18th to 20th September. This will be an important forum for GPs to attend to get a clear sense of how LPs will be weighing various considerations in the coming years, as they seek to partner with the best fund managers to drive future performance.

Delegates will have the chance to hear LP views on topics under the moniker “Recalibrating the performance equation”, including:

🟠 The $30tn Question: Can Private Markets Continue to Grow and Still Deliver Outsized Returns?

🟠 Green Returns: How Real Can They Get?

🟠 Picking the Best: How LPs Select and Access Top Performers

🟠 Top Quartile vs. Best In Class? How LPs Also Value Operations, Culture and Alignment of Interest

🟠 Show Me Some DPI! New Exit Routes and Liquidity Options

🟠 Co-Investment Trends and Performance

There is no denying that challenging macroeconomic conditions have impacted performance. PE buyout funds generated a 1-year IRR of 39.5% in 2021 before falling sharply to -6% in 2022; by comparison VC funds fell from approximately 58% to -14.9% over the same period, according to McKinsey’s Global Private Markets Review 2023.

Market headwinds actually meant that performance dispersion, which can often vary substantially between top and bottom-quartile funds, narrowed in 2022, as larger funds saw their performance drop. This narrowed the gap within private equity from a 10-year average of 33.8% to 21.6%. That being said, performance between the industry’s bottom and top performers last year ranged from 11.4% to 29.8%, meaning manager selection is still a highly critical exercise for investors.

A recent paper by JP Morgan Asset Management on this topic, looked at active management within real estate. Its analysis found that tilting a portfolio by 10% each year (across a range of RE strategies) can potentially generate up to 150 basis points of outperformance annually.

True value creation

Large investors such as Adams Street Partners, who manage over $55 billion in primary and secondary multi-manager funds, focus their manager selection on those who have the ability to invest in sectors that are going through change/dislocation, and growing faster than the macro environment.

As Mattias de Beau, Partner, Primary Investments, explains, having true value creation skills and levers to pull will now become even more important as GPs cannot rely on the availability of cheap debt for gearing and financial engineering. The focus now has to be on growing revenue and margin expansion.

“That is what we are looking for when doing due diligence on managers’ performance,” says de Beau. “What environment have they operated in? Was it possible only in a bull market and the strategy is now less relevant? Those who have used a lot of leverage have typically not made it into our fund-of-fund portfolios.”

In terms of selecting and accessing top-performing managers, European investors remain focused on small and middle market managers “where we believe alpha can be generated through active manager selection”, says Pauline Wetter, Principal at LGT Capital Partners.

“Topics like strong alignment of interest where teams put significant personal investment in their own funds will likely increase in importance.”

This echoes a recent comment made to the Financial Times by Apollo Group’s chief executive Marc Rowan, who believes this year has marked the end of an era for private equity. As borrowing costs rise, Rowan said that PE firms would have to go to investing “in the old-fashioned way” and will actually have to be good investors.

“At this stage, we do not expect a meaningful drag on returns in the segments we are investing in,” says Wetter. “Looking at the last 25 years, 2023 has the potential to be a good vintage, as the asset class tends to demonstrate strong performance in early cycle/post-crisis vintage years as well as in volatile markets.”

Non-sponsored private debt

While investors may look to recalibrate their performance expectations if, as seems likely, buyout shops reduce the amount of leverage, they may have reason to feel optimistic for private credit and other yield-generating asset classes like infrastructure. As interest rates have risen, this has played to the advantage of direct lending funds as well as distressed debt and special situations funds, only too eager to plug the funding gap left by investment banks.

Investors like Swiss-based DECALIA are expecting higher returns from private credit in today’s market environment.

“If you pick well and know where to apply, I think it is the case that higher interest rates will benefit investors and, in certain segments, you’ll also see higher spreads,” comments Reji Vettasseri, Lead Portfolio Manager, Private Markets, DECALIA.

To what extent spreads might further rise varies by strategy. Even though direct lenders providing financing to PE sponsors are buoyed by the fact that rates are higher (given that loans are typically floating rate), they are, at the same time, suffering from reduced deal volume.

“Moreover, deal volume has less leverage attached to it. This means both the number of deals and the amount of debt per deal have fallen,” adds Vettasseri.

This will require investors to be flexible in how they source top-performing credit managers and, crucially, how effective their deal-making skills are: are they executing and completing deals and if so, how are they expanding their strategy to drive performance?

Vettasseri thinks certain types of niche credit strategies could present good investment opportunities, where they are able to benefit from sectors where fewer equity deals are being conducted, such as technology lending.

“There are a number of fundamentally good companies that are growing as fast as they were two years ago, but which have seen their values decline as equity markets are less frothy. It becomes quite attractive for some of these companies to defer their next equity raise and instead raise a certain amount of debt to optimize their capital structure,” says Vettasseri.

In his view, non-sponsored companies in sectors like technology have the opportunity to generate “interesting kinds of returns”, as well as certain areas of the credit secondaries market.

“I think most private credit investors expect and demand higher returns from fund managers. And you see returns going up disproportionately in sectors that aren’t inherently tied to private equity,” he adds.

A time for realization

One aspect that investors are paying close attention to when recalibrating performance expectations, is the ability for GPs to realize returns. Distributions to paid-in capital (DPI) are becoming an important KPI as investors dial up the pressure on GPs in order to re-invest capital in new funds. This will be the focus of one of the panel sessions on Day 2 (20th September) of IPEM and according to de Beau, DPI has become “a more critical factor in the current environment”.

2021 was a record year for liquidity, distributions, and deal activity levels. “We had almost double what we would expect in a normal year,” he says. “Last year, the first half was very strong while the second half fell off a cliff, ending around 25% behind an average year.”

“This year has started slow with a run rate of half of a normal year but the final outcome will depend on activity in the second half.”

“A lot of exits were brought forward in funds in 2021, ahead of 2023 and 2024. There’s an element of asset maturity in the portfolio that still needs to develop, which is holding back liquidity and there’s also the divergence between buyers and sellers in terms of pricing. In terms of alternative exit routes, GP-led transactions have been a big feature of the secondary market for a while and are likely to remain so.”

He also believes that in a more difficult fundraising environment, GPs may need to be more flexible in terms of delivering co-investments to their LPs to fill any potential funding gaps.

Seeking out the industry’s top performers has always been vital and in that sense, nothing much has changed. They still need to be good at everything: originating and finding new deals, commercial analysis, term structures, and having the right culture and mindset.

“Also, are they exceptional at something? Whether that is a segment there are focused on, a differentiated level of judgment and due diligence, operational value-add capabilities, or a structure that they’ve created,” says Vettasseri, adding:

“Cycle-turning events catch out those who are rigid in their thinking. We like managers who are able to understand things change, and are willing to adjust their assumptions to look at the world differently.”

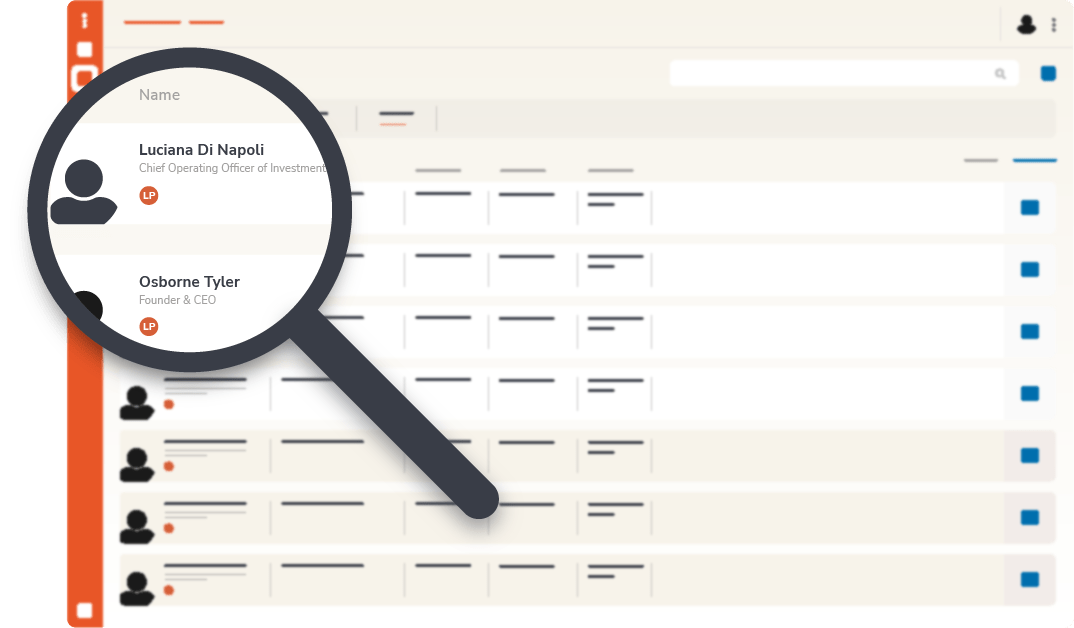

☑️ Maximize Your Networking Potential:

Tap into advanced tools for seamless connections. Use our innovative algorithm for perfect matches within the industry.

☑️ Unrivaled Event Preparation:

Plan meetings, access the participants’ list, and customize your agenda effortlessly.

☑️ Stay Informed, Stay Ahead:

Real-time updates, offline event program, and all info in one place.

☑️ Experience the Power of Collaboration:

Engage with the private equity community.

☑️ High-quality connections using our affinity algorithm.

☑️ Filter opportunities to minimize irrelevant solicitations.

☑️ Manage communications with our secure email system.

☑️ Access exclusive reports, replays, photos…

☑️ Maximize your event experience.

IPEM Paris 2023 – The Daily Spin, September 20th

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.