IPEM Cannes 2024 – The Daily Spin – January, 25th

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Dear IPEM Friends,

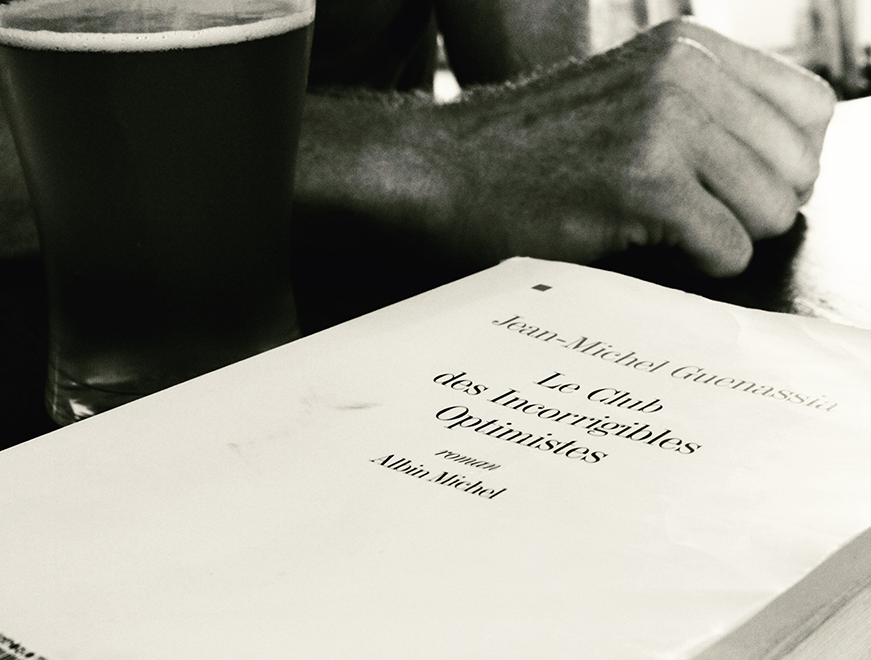

In 2009, Jean-Michel Guenassia published “Le Club des Incorrigibles Optimistes”. The novel had an extraordinary popular success in France, which is regularly ranked as the most pessimistic country in the developed world, only surpassed by Iraq and Afghanistan in the world moaners championship. This refreshing book tells the story of 12-years old Michel who is growing up in Paris in the late 50s. The boy develops a genuine passion for literature and a strong friendship with a group of East-European immigrants that play chess in the smokey room of a café – the self-called “Club of the Incorrigible Optimists”. These men from Hungary, Russia, Romania, Poland… have all left their countries and their families in the tragic circumstances of the WWII and the descent of the iron curtain. But they took and kept with them an amazing stamina and optimism.

“European GPs are overwhelmingly optimistic for 2021”

I sometimes feel private equity is another club of “incorrigible optimists”. Spoiler alert: the results of our 3rd annual PE survey (to be released on Feb. 1st) will prove it. European GPs are overwhelmingly optimistic for 2021 (yes, 2021) – as it was already the case in our previous surveys. And you can feel it when you meet people in private equity (even on Zoom); overall, they are genuinely positive even in these dire times. I don’t think this means that private equity is “out of touch” with reality, far from that. Private equity knows like no other shareholder how difficult it is to run and grow a business – especially in adverse conditions like this pandemic. It knows the tragedies that people endure every day. In fact, common sense in the investment world has always leant toward pessimism rather than optimism. As Oaktree’s Howard Marks said in a recent interview: “when the level of optimism is high, there is usually more room for disappointment”. For this reason, “worst case” scenarios are closely monitored by investors (that rarely rely on a “best case scenario”). But despite all this, private equity remains driven by the secret force and power of optimism. No matter the circumstances, it tends to keep a strong confidence in its purpose, in its approach, in people and in the future in general.

“Private equity knows like no other shareholder how difficult it is to run and grow a business – especially in adverse conditions like this pandemic”

There are a few reasons that can explain this optimistic DNA. The first is that private equity people are long-term oriented and have time to endure some bumps on the road. They do not freak out when public markets tumble, when a storm strikes or when an election brings a lousy candidate to power. They are neither overly ecstatic when stocks break new records or when a new vaccine is invented. In private equity your mood does not have to be balloted by the daily flow of news. If you are investing in a good business, with good people, and take the time to deliver your plans – things are likely to go well. Private equity is also “in control”. As a shareholder, together with the management of portfolio companies, it is able to take action and fix things quickly. In this Covid crisis, private equity was probably one of the best possible stewards for a business. With such an entrepreneurial and “hands-on” approach, nothing is a problem, and no problem lasts long – it is all about finding solutions. Martin Selingman, the guru of “positive psychology” gave an interesting definition of optimism: it is not at all about expecting the best to happen. Being an optimist is mainly rooted in how we approach and handle the negative (these worst case scenarios!). Private equity probably excels in this domain…

At the end, the same Howard Marks acknowledged it in his latest memo: “To be a good equity investor, I think you have to be an optimist; certainly, it’s no activity for doomsayers.” This is also why we love private equity in these troubled times.

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.