IPEM Cannes 2024 – The Daily Spin – January, 25th

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

“Getting Deals Done”. That’s the focus of IPEM Cannes 2024 as it prepares to celebrate its 10th edition of what has become Europe’s leading private markets conference.

Private equity firms live and die by their ability to source exciting firms to buy, improve, and sell. It’s a simple concept that has remained unchanged for four decades. Yet this past 12 months has been anything but straightforward, both in terms of deploying capital and completing successful exits.

Global PE exits through September 30th were 1,294 according to S&P Global, some way down on 1,584 exits for the whole of 2022, although there were signs of recovery in Q3, with 467 exits recorded. In the US, however, exit activity remains below pre-pandemic levels, with Q3 2023 representing the second-lowest period since Q3 2010.

Whichever way you look at it, the bid/ask spread on getting buyers and sellers to agree on a price has been wider than normal, as the market recovers from rising interest rates. DPI has become increasingly important to LPs wanting realizations on their investments, as they manage their portfolios, putting GPs under pressure. This topic will be the focus of discussion during the morning of Day 1 of IPEM Cannes 2024: “Exits 2024: a Bogey or Albatross Vintage?”

While headline figures may not look too encouraging, there are plenty of GPs selling assets in the current environment. Abris Capital Partners, the ESG transformation specialist, announced in December 2023 a preliminary agreement to sell Velvet CARE to Partners Group. Velvet CARE manufactures paper hygiene products. During its ownership, Abris has overseen a 5x increase in EBITDA and a 2.5x increase in sales.

“Looking from the perspective of the EU-11 countries in Central Europe, I have to disagree that exits have been challenging,” says Pawel Gierynski, Managing Partner, Abris Capital Partners. “Changes in the geopolitical and economic landscape have contributed to a definite recovery in the exit environment, and we’ve been pushing hard over the past six months to take full advantage of this new reality.”

“Yes, the IPO environment remains challenging. But the resurgence of interest in Central Europe from many strategic and financial investors allows us to exit our more mature and successful portfolio assets, and to do so at very attractive valuations.”

Over the calendar year 2023, Inflexion has agreed to eight exits, which will return GBP1 billion to its LPs.

“If you look at where those exits came from and who was buying them, quite a few of them were to international corporates: The Goat Agency was sold to the international advertising group WPP, Scott Dunn was sold to an Australian corporate, The Flight Centre Travel Group. We also sold to international PE groups such as Abry Partners (who acquired Chambers and Partners),” explains David Whileman, Partner at Inflexion where he leads its Partnership Capital fund, which takes minority stakes in high-growth firms.

Inflexion also runs a buyout fund and an enterprise fund. Combined, the three strategies are helping them both on the deal creation side and on the exit side.

“Inflexion’s formula is to task our team to go out and find the best, most exciting firms in specific sectors. With three different funds, we can be relevant to each individual situation. Add in the fact that we have a value acceleration team and when it comes to exit, we have built desirable businesses that are able to achieve market-leading returns,” adds Whileman. “If you want to grow value in businesses you’ve got to grow revenues. This not only leads to more jobs but also makes the businesses fundamentally more attractive to an increasingly global buyer market.”

2023 was a difficult time for GPs to get deals done. It was, in many respects, a year to forget. Global PE deal value for the year was $846 billion, down 40% in 2022, as PE groups chose to wait on the sidelines; not ideal for investors who are paying 2% management fees.

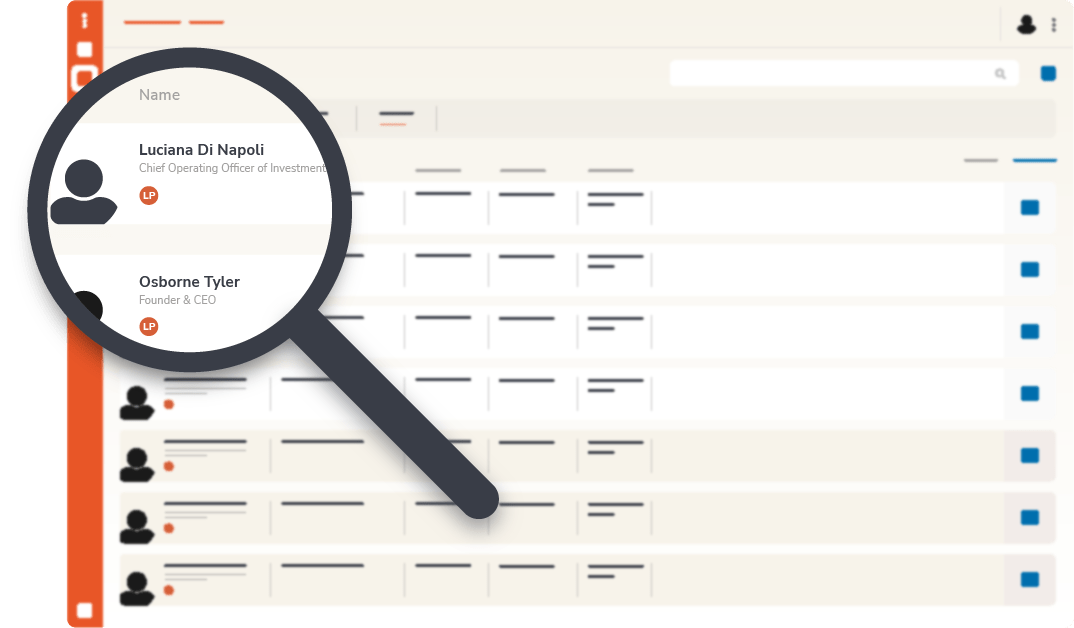

Understanding how and where GPs are looking to complete deals, and what their deal pipelines look like, is most likely to be top of the agenda for LPs. A range of topics throughout the morning of Day 1 (January 24th) will be discussed, on panels including “Getting creative with deal sourcing strategies”, and “Will large deals be back in 2024?”

“I expect to see more deal activity in 2024 compared to 2023,” comments Christian Melby, Partner and CIO at Summa Equity. “It depends of course on a stable geopolitical situation and that inflation and interest signals remain stable to positive. Strategics will continue to do M&A and there will be more PE activity as differences in valuation expectations between buyers and sellers will diminish.”

In the current market, the challenges are very different in the growth equity and buyout segments of the private equity market, according to Gierynski.

“As a GP investing predominantly in growth equity in Central Europe, we have few concerns about accessing interesting investment opportunities on a non-intermediated basis. Having said that, we continue to try to employ more technology in our investment processes. Rather than deal sourcing, this is more to help us gain a quick understanding of the competitive landscape in certain areas, and for benchmarking, not only in the local context but also globally.”

At Inflexion, Whileman believes that the deals that are being done tend to be more complex than plain vanilla. “The majority of our deals are entrepreneur-led,” he says. “We do some corporate partnering deals too with large businesses, which tend to be off-market because they are quite complex. We just did one with Allen & Overy called aosophere. These are not standard buyout deals although we do pursue such deals when the opportunities arise.”

With the cost of debt markets, every single deal has to stack up and make economic sense. The combination of less leverage and more equity commitments places greater emphasis on a GP’s ability to drive real, value-added growth, and ultimately generate good returns.

“If you are well capitalized there are new deals to be done but you’ve got to bring more than money to the table to attract the best investments,” says Whileman. “You need to demonstrate your proven ability to partner with firms and support their growth. On exit, the debt markets remain tough so any deal has to stack up on the fundamentals more than ever – high margins, low customer concentration, strong recurring revenues, and a large total addressable market, for instance.”

LPs are aware of the challenges of dealmaking. Some PE groups are choosing not to deploy capital because they know they aren’t going to easily fundraise and as one LP comments, “I get the impression that some managers are choosing to maintain their dry powder. That is not necessarily a good sign.”

Jean-Francois Le Ruyet, Partner at Quilvest Private Equity, says that in the current environment, “it gives you an opportunity to see who the really good funds are from the not so good. You can benchmark who is buying firms versus who is not.”

One of the factors that Quilvest is looking at closely is shareholder control within the GP and the future success of the management firm; what is the succession plan? Are the founders considering a GP stakes deal to raise liquidity?

“We are looking at these things to try to infer how this might impact the future quality of investments going forward. We are focusing a lot on this with managers who are in fund VII, VIII, or IX, to better understand what is happening at the GP level,” confirms Le Ruyet.

M&A consolidation

Such is the level of competition facing GPs today – both in terms of dealmaking and fundraising – that some in the industry expect to see quite a bit of consolidation through mergers and acquisitions among PE groups. This will be debated during the conference on the panel “Is 2024 a good vintage for sponsor M&A?”

As reported by the Financial Times, Partners Group believes the number of market participants could shrink to as few as 100 over the next decade, with chief executive David Layton noting that the industry had entered a ‘new phase of maturation and consolidation’.

“The biggest driver for this seems to be large capital allocators wanting to create efficiency in their programs by allocating larger amounts of capital to fewer sponsors. Another driver is that scale seems to matter more, from a regulatory and competence perspective,” suggests Melby.

As PE firms prepare to get deals done in 2024, team stability and retaining top talent will be essential.

“What you don’t want is for people to be so unmotivated that they leave to join another firm,” comments one European LP. “That happens sometimes where the founders aren’t willing to share the economics. It creates uncertainty within the GP. It’s important, for us, to have motivated teams in place.”

☑️ Maximize Your Networking Potential:

Tap into advanced tools for seamless connections. Use our innovative algorithm for perfect matches within the industry.

☑️ Unrivaled Event Preparation:

Plan meetings, access the participants’ list, and customize your agenda effortlessly.

☑️ Stay Informed, Stay Ahead:

Real-time updates, offline event program, and all info in one place.

☑️ Experience the Power of Collaboration:

Engage with the private equity community.

☑️ High-quality connections using our affinity algorithm.

☑️ Filter opportunities to minimize irrelevant solicitations.

☑️ Manage communications with our secure email system.

☑️ Access exclusive reports, replays, photos…

☑️ Maximize your event experience.

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.