IPEM Cannes 2024 – The Daily Spin – January, 25th

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

The macroeconomic environment has faced considerable headwinds in 2022. Rampant inflation, which started with supply chain issues created during the Covid-19 pandemic and accentuated by the war in Ukraine, has pushed central banks to raise interest rates and begin quantitative tightening. For buyout firms, this has led to a reduction in leverage and syndicated bank loans, prompting the likes of Blackstone to facilitate its own debt arrangements with specialist credit lenders to complete the $14 billion takeover of Emerson Electric.

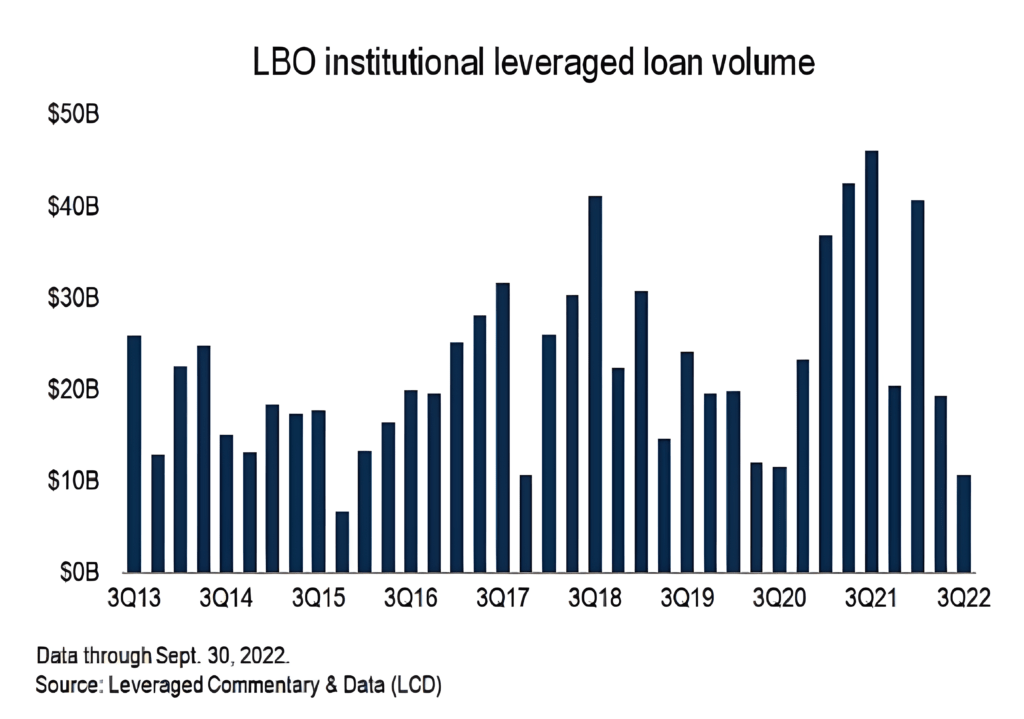

According to Pitchbook, PE dealmaking in Q3 was well down on previous years. US buyout firms raised just over $10 billion of leveraged loans, the lowest amount in seven years and in stark contrast to the $46.1 billion raised in Q3 2021.

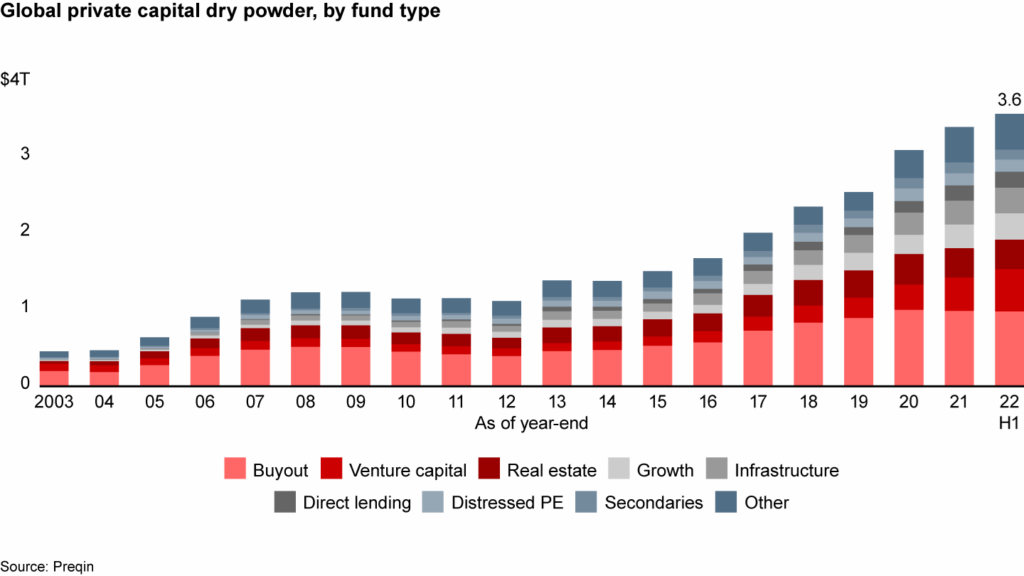

What makes the Blackstone deal interesting is that it demonstrated creativity in terms of both the equity and debt financing. If Pitchbook’s figures become a canary in the coalmine, LBO players may have to come up with new ways to complete deals. It will be intriguing to see if the private equity playbook experiences further innovation in 2023, signaling a new way forward as the industry puts an estimated $3.6 trillion of dry powder to work.

Even among industry titans, there has been a dispersion of performance in 2022. KKR’s private equity portfolio was marked down 4%, whereas Ares Management recorded a 2.7% rise based on latest results. Against a challenging macro backdrop, the next 12 months could certainly be a rollercoaster ride as PE groups play both defense (supporting struggling portfolio companies) and offense (seeking out distressed opportunities).

Jared Gross, Head of Institutional Portfolio Strategy for JP Morgan Asset Management says that multiples have declined significantly, markets are off a lot, and “if you have dry powder, obviously that’s a great time to be an investor”. On a recent JP Morgan podcast, Gross stated: “We probably just have to be a little thoughtful about which sectors we look at, recognizing that it’s a difficult operating environment. There’s less favorable conditions in certain sectors, and financing costs, which are a huge part of private investing, are up significantly.”

GPs will likely need to ask themselves a number of searching questions in 2023:

• What concessions are they willing to make by increasing equity/debt and reducing net IRRs?

• How should they structure debt with non-bank providers?

• What changes must they make to their operating model to drive even further value creation?

• What entry point multiples are they willing to consider, against a recessionary backdrop?

• Do they need to update the way they stress test target companies pre-investment and adjust their return expectations?

Ultimately, what characteristics does PE need to weather the macroeconomic storm?

Investors have, rightly, been concerned by the extent of volatility in public markets and the contagion effect this has had on private markets, starkly evidenced by the retrenchment in valuations in the VC space (most notably tech/fintech).

This is a new economic cycle for some PE/VC firms. As such, they can expect investors to double down even more on assessing their ability to not only protect assets in a down market, but develop cogent strategic growth plans that place future value creation at their heart.

To maintain confidence in the asset class, LPs are going to want to understand the tools that GPs have to drive improved profitability and margin expansion in a higher interest rate environment, when conducting their manager selection process. Indeed, will this environment potentially lead to portfolio rotation within private markets?

Private credit could prove popular in 2023, given the ability for private credit managers to roll out floating rate loan products: in a higher rate environment, this becomes an even more attractive proposition provided credit selection is rigorous. Indeed, like other areas of the private market industry, private credit is not without its risks. According to Coller Capital’s private equity barometer, while North America and Europe are viewed as the most attractive markets over the next two years, one fifth of European investors and one third of North American investors expect higher rates to lead to higher default rates in their private credit portfolios.

Some are of the view that growth equity could be well positioned in today’s new macroeconomic reality.

Marc Romano, head of Mirova Impact Private Equity Funds (an affiliate of Natixis Investment Managers), believes that buyout funds “may look vulnerable to rising interest rates and looming recession”, and that declining economic activity will hold back the organic growth of mature companies. “Our view is that the growth stage will be less impacted, since growth companies have lower levels of debt and higher growth rates,” he recently commented.

While 2023 could be a testing period for GPs to showcase their worth to investors, in the long run it will likely further reinforce the value, and reputation of private equity. If so, Europe’s private equity industry has the potential to thrive in a new reality.

The Morning of Jan. 24th – Day 1

Morning POWERTALKS

Theme: Adapting To New Realities

Welcome Speech

Adapting To New Realities | KEYNOTE

A Perfect Storm: The Macro Forces Impacting Private Markets

Building Resilience In A Downturn

Can One Find Value In Current Private Markets?

A New Chapter In The GP Landscape

LP Comments: Investing In A World Of Low Growth, High Inflation And High Rates

Morning SUMMITS

WOMEN & DIVERSITY IN PE SUMMIT

(Sponsored Summit)

Morning SOCIAL EVENTS

LP BREAKFAST

(Sponsored Event)

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.