Deep dives with the IPEM Community

During IPEM Cannes | Wealth 2025, we asked Private Markets experts from around the globe to share some industry insights by answering a few questions…

IPEM, International Private Equity Market, is the premier relationship broker for global private equity. IPEM Events are world renowned for bringing together the industry’s leading investors, allocators, advisors, and service providers allow to Its dynamic business format is designed to drive innovation and shape the debate across private markets, delivered in a way that champions ESG responsibility. Below are some key insights on impact investing that came out of our last two events.

The private wealth revolution is surging ahead. Private market evergreen funds, or ‘semi-liquid’ funds, are the talk of the town, as wealth platforms increasing turn to private market groups to distribute their fund strategies to a wider cohort of mass affluent investors. The drawbridge to access private equity is finally lowering. It is no longer the preserve of Wall Street…now Main Street gets to enjoy the myriad advantages to investing in private assets. Assets under management are in excess of $320 billion across US- and EU- domiciled funds.

For a growing number of GPs, private wealth is a key tenet of their long-term business strategy with blue chip names such as KKR expecting evergreens to represent 50% of its fund offerings over the coming years. And while the universe of fund managers offering direct investment evergreens (investing directly in companies compared to investing indirectly through multi-GP fund products), remains modest, private banks expect it to rapidly expand.

This expansion will improve the way private wealth firms use evergreens to tailor specific investment outcomes for their HNW clients. Private wealth is even more discerning than the institutional space. Consequently, knowing that the right depth and breadth of products is available will be pivotal to distribution platforms – particularly within European private banks seeking to provide bespoke solutions. Firms like Pantheon are focusing on mid-market managers across private equity, private credit and infrastructure in response to increased specialization: a trend that is likely to grow stronger.

Even though access has improved, private markets remain significantly under-penetrated within the HNW / mass affluent sector. A report by iCapital and Boston Consulting Group in 2022 suggested that investment by high net worths into private equity was expected to reach $1.2 trillion by 2025. And while individual investors hold roughly 50% of the estimated $295 trillion in global assets under management, only 16% is held in alternative assets.

At the recent IPEM Cannes | Wealth event (Jan. 28 – 30), attended by over 3,600 delegates, a live poll revealed optimistic sentiment in regards to the influence private wealth will have on private equity fundraising, with the majority of respondents expecting it to account for 10% to 25% of total fundraising by 2028.

As highlighted by Goldman Sachs Asset Management, one of the key benefits of evergreen funds is that they “obviate much of the complexity of achieving, maintaining, and managing a private markets program over time”. The single drawdown functionality of evergreens is just as attractive to sophisticated institutional investors as it is to individual investors.

Day one fully invested avoids treasury management considerations commonly associated with multi- drawdown vehicles but this is not to suggest that evergreens will bring an end to traditional close-ended funds.

While it is expected that the proven liquidity of evergreen funds will blur the lines between public and private equity – with evergreens set to become the ETF equivalent for private markets – it is unlikely that they will find an equal footing with closed-ended funds. Evergreens representing 50% of private market AUM by 2030 was considered the least likely outcome during live polling at IPEM.

Leading investment managers such as KKR hold the view that blending evergreens and drawdown funds have the potential to produce higher compounded returns and lower risk, both in terms of reinvestment and diversification for individual investors. Again, there is no suggestion that private wealth views evergreen products as a panacea.

As the ecosystem develops, they will need to be used carefully, with a key focus on the manager’s track record being just one of a host of due diligence considerations, including liquidity management, quality of investment platform and deal flow, education/ongoing engagement and scalability.

This could require some degree of discipline on the part of private markets firms to ensure that the industry does not end up with a deluge of evergreen products that fail to scale up – this presents a tangible risk to private banks as they develop distribution partnerships and could lead to repetitional risk both for GPs and distributors. Indeed, it was noted during IPEM by Agathe Bubbe, Director – Wealth Solutions, Investor Relations at Eurazeo, that while evergreens are a fundamental change for the market, “not all strategies are suited to these products…scalability is a necessity.”

Controlling the supply side, in order to properly meet demand in a considered fashion, is something that wealth platforms and GPs are likely to monitor closely. There will, as with any structural trend, be those who look to jump on the bandwagon.

One only has to look at the greenwashing risks that have arisen in response to sustainability-focused funds, with mis-characterization of ESG investment objectives, to understand that the same risks could equally arise with evergreens; perhaps “evergreen washing” will become a term that enters the industry vernacular in the near future. Evergreens that launch with limited appeal and experience stagnant AUM growth are likely to be detrimental to all concerned: it would be, quite simply, a ‘bad look’.

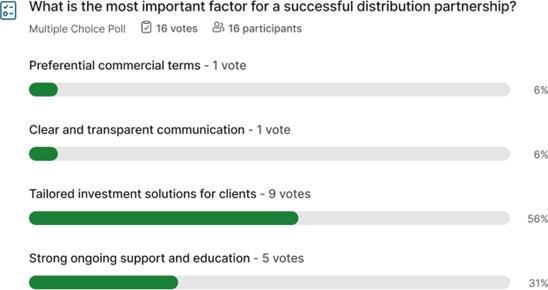

Live polling at IPEM found that the ability to provide tailored investment solutions was regarded as the most important factor to developing a successful distribution partnership. What this underscores is the need for GPs to do their homework before considering whether to launch an open-ended product. Does the strategy have sufficient scope and deal access to handle the unique demands of a quarterly redemption vehicle? And even if it does, does the manager’s brand, internal architecture and overall value proposition resonate with wealth partners? This is the key point: any new evergreen fund has to meet a specific investment objective for private wealth for it to succeed, and avoid scaling issues.

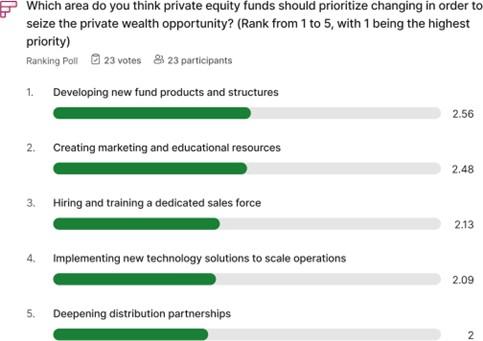

Deepening distribution partnerships should be a top-line priority for private markets groups as they position themselves to seize the private wealth opportunity. Technology will also play a role in ensuring aspects such as client onboarding, fund reporting and education/communication are clear and simple for the mass affluent market. To further drive the private wealth revolution, infrastructure will need to improve. Platforms like iCapital, Moonfare and Titanbay have become leading platforms for GPs including the likes of KKR, Blue Owl and Carlyle to scale their fundraising. A newly expanded relationship with LPL Financial announced by iCapital illustrates the ongoing drive to support advisors and their clients on their private markets journey.

However, the lack of a standardized technology for private wealth remains a challenge. Further innovation is needed internally within investment firms – i.e. investment in AI tools, dynamic reporting tools – to allow them to scale their operations effectively.

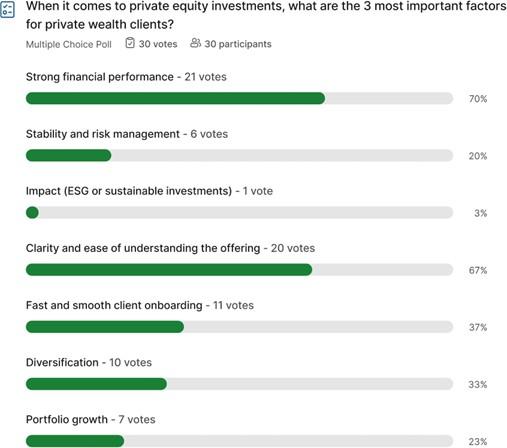

Educating advisors and their clients on the value proposition of asset classes like private equity is just as important as having the right operational infrastructure in place. It is a message that came through loud and clear during many of IPEM’s private wealth panel discussions. A focus on clarity of message, as well as consistency of track record, will be crucial to driving AUM growth in semi-liquid funds over the coming years. Partners Group, one of the earliest pioneers in designing evergreen fund solutions, has committed significant internal resources to training and educating wealth advisors: last year alone they trained 600 advisors.

Financial performance and education are deeply interlinked within the world of evergreen funds. Liquidity management is a core element of the educational drive, requiring investment firms to take care in explaining how liquidity is generated and provisioned on a continual basis to meet quarterly redemptions. Semantics can be misleading, however. Individual investors who see references to semi-liquid will typically be swayed by the ‘liquid’ reference and assume these products operate no differently to mutual funds or ETFs.

Explaining the long-term nature of private equity, for example, is fundamental to ensuring mass affluent investors understand what it is they are buying, to guard against misconceptions. Gating is a good example of this.

Often, in the broader media, it is perceived as a negative impact on investors. However, as the use of gating likely becomes more prevalent as an active liquidity management tool as the evergreen universe grows, investors will need to understand that such a product feature is designed to protect them. Managers who use gating effectively will stand out from those who are jumping on the evergreen bandwagon and lack the skill to manage these complex products.

Globally, an estimated $85 trillion of private wealth transfer is expected within the next 20 to 25 years.

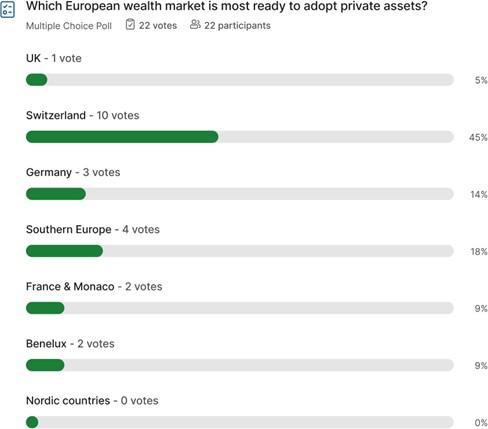

This offers a significant tailwind for private market evergreens. It could usher in the end of traditional 60/40 investment portfolios, with investment advisors instead moving towards a 50/30/20 allocation profile where private markets represent 20% of the overall exposure. Certain European markets are likely to be better placed than others to capitalize on this tectonic shift, most notably Switzerland, which has long enjoyed a reputation as one of the world’s leading private wealth hubs.

This was cited as the European wealth market most ready to adopt private assets during live polling at IPEM Cannes | Wealth. That is not to say that other leading countries such as France and Italy will not enjoy their own private wealth revolution, with more than $300 billion expected to flow in to Italy’s private markets in the coming years. As evergreens become more widely understood, GPs have the opportunity to set up teams in these markets to build key distribution partnerships. In France and Monaco, firms such as Groupe Crystal are busy acquiring IFAs as investors broaden the scope of their retirement assets while Paris-based financial services group ODDO BHF recently chose to partner with S64 to improve access to its private markets funds.

UBS has become the dominant distribution partner of choice to bluechip fund managers, with the likes of BlackStone, Hg and CVC Capital Partners using the Swiss bank’s platform to scale their evergreen fund offerings.

As the private wealth revolution continues, competition to get products on the shelves of Europe’s private banks, in Switzerland and beyond, looks set to accelerate. Giving distribution partners and individual investors an ever wider choice of opportunities to tap in to all that private markets have to offer.

During IPEM Cannes | Wealth 2025, we asked Private Markets experts from around the globe to share some industry insights by answering a few questions…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to watch the Infrastructure Summit Replay.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to watch the Private Debt Summit Replay.

Fill in the information below to watch the Webinar Replay.

Fill in the information below to download the LP Package.

Fill in the information below to watch the Climate Investing Summit Replay.

Fill in the information below to download the Factsheet.

Fill in the information below to hear the full podcast.

Fill in the information below to hear the full podcast.

Fill in the information below to hear the full podcast.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to watch the Venture & Growth Summit Replay.

Fill in the information below to watch the Impact Summit Replay.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.