By AMAF in partnership with Monaco For Finance

introduction by Mr Nicolas FEIT CEO Société Générale Private Banking (Monaco) as Chairman of the Commission for the Promotion of the Financial Marketplace

Two-Part Session: Understanding Monaco’s financial Regulatory Framework and Business Opportunities

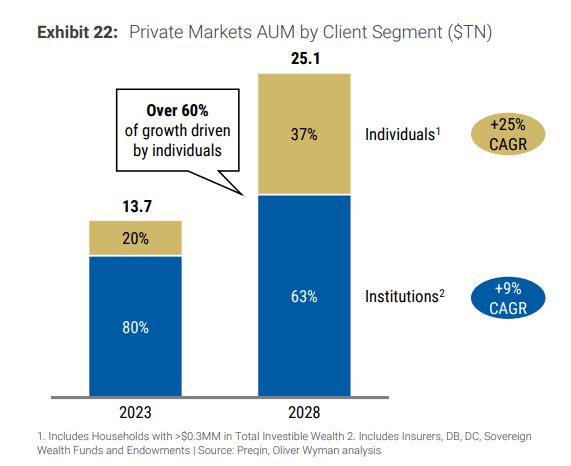

- An overview of what is driving investor demand in Private Equity in Monaco

Mrs Valentina SLOBODENIUK, Head of Investment Consultants, Edmond de Rothschild (Monaco)

Mr Olivier DAUMAN, Global Head of Investor Relations Private Markets, CFM Indosuez Wealth Management

- Being a GP in Monaco: Regulation, Case Studies & Advantages

Mr Anthony STENT-TORRIANI, CEO, Monaco Asset Management

Mr Massimo PASSAMONTI, CEO, Privatam