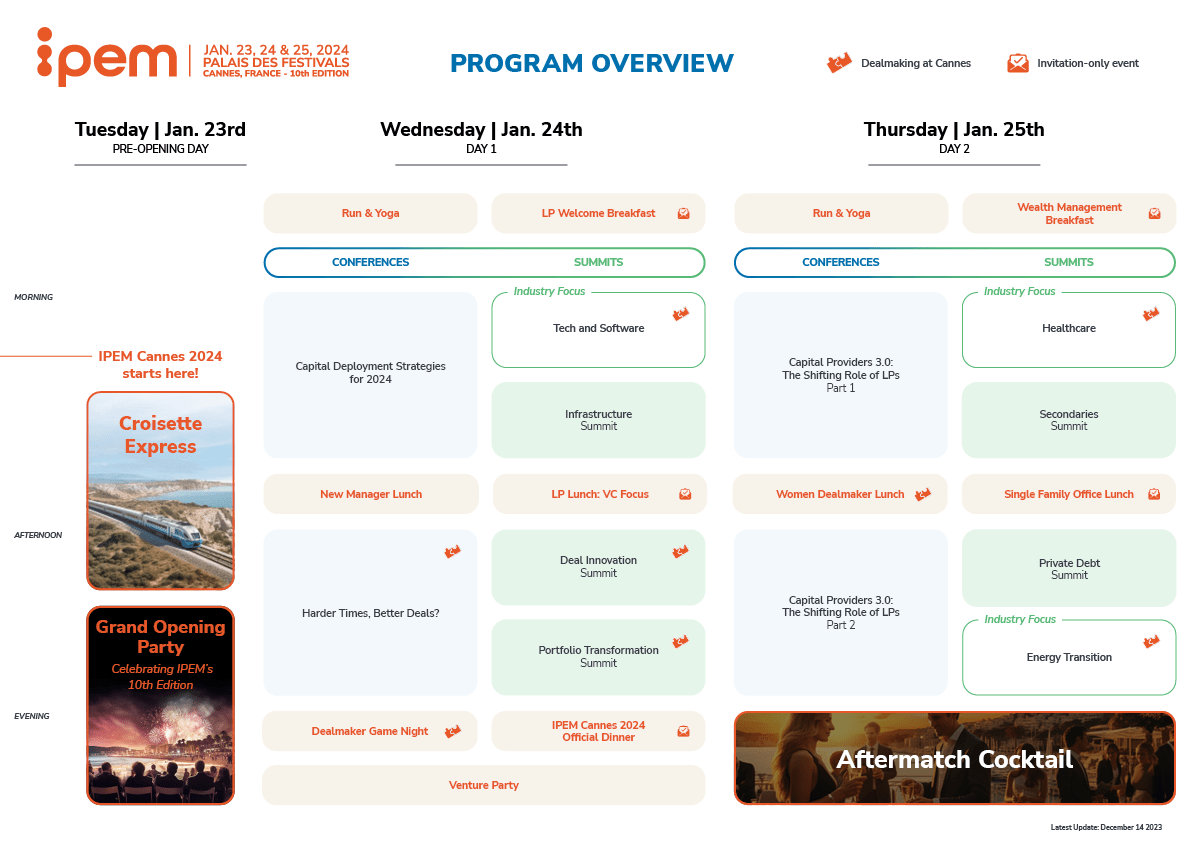

IPEM Cannes 2024 – The Daily Spin – January, 25th

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Will private equity keep up its reputation as exceptional dealmakers? How will the industry address its financing headwinds? Where and how will top dealmakers source lucrative deals next year? Will PE firms explore new exit options, as LPs are pressing for DPI? How will the asset class innovate regarding deal structuring, portfolio management, and value creation? For its 10th edition, IPEM is getting private markets back to basics again and celebrating its amazing ability to get deals done. See you there!

Co-Chief Executive Officer

-

EURAZEO

.................................................

Christophe Bavière is co-CEO of Eurazeo since February 2023 and has been a member of the Executive Board since 2021. He was also Chairman and Founder of Idinvest Partners a Private Equity company which joined forces with Eurazeo in 2018 and was fully merged in 2020. Prior to this, Christophe Bavière held senior positions within the Allianz Group where he managed the investment programs for the group.

Head of Group PE Portfolio Management, CEO of Lion River

-

GENERALI

.................................................

Working for the Generali Group over the last 16 years, taking various responsibilities, mainly managing the Group Private Equity Portfolio and corporate finance international operations. Currently serving as Generali Head of Group Private Equity Portfolio Management and as CEO of the Private Equity Investing company (Lion River I N.V.), also including the responsibility of coordinating the legal and tax due diligence.

Group CEO

-

WENDEL

.................................................

Laurent Mignon is Wendel’s Group CEO since December 2nd, 2022, and Chairman of the Board of Bureau Veritas since June 22nd, 2023. Before joining Wendel, Laurent Mignon served at Groupe BPCE from 2009 to 2022, where he was Chief Executive Officer of Natixis and a member of the Executive Management Committee of BPCE (including a member of the Management Board since 2013) from 2009 to May 2018, and Chairman of the Executive Board of Groupe BPCE from May 2018 to December 2022.

Partner, Co-CEO

-

APAX PARTNERS

.................................................

Andrew Sillitoe has been Co-CEO of Apax since 2014. He is Chairman of the Apax Global Investment Committee and the Digital Investment Committee, amongst others. He is also a member of the Apax Executive Committee. He has been based in London since joining the Firm in 1998, focusing on Tech & Telco investments. Andrew has been involved in a number of investments including Inmarsat, Intelsat, King, Orange Switzerland, TIVIT, TDC and Unilabs.

Partner

-

PANTHEON

.................................................

Helen is a Partner in Pantheon’s European Investment Team and the co-manager of our listed global private equity investment trust, Pantheon International Plc. She is a member of the International Investment Committee. Helen joined Pantheon in 2004 from Russell Investments in Paris where she was Managing Director with overall responsibility for private equity in Europe.

Stay tuned, more speakers coming soon…

Sponsored by

Step into a decade of distinction with our "Grand Opening Party," marking the commencement of IPEM Cannes 2024's extraordinary 10th edition. Prepare to be captivated, for this is not merely a celebration – it's your exclusive invitation to immerse yourself in an evening of joy, rhythmic melodies, and unmatched grandeur. As a participant of IPEM Cannes 2024, you're exclusively invited to experience an unforgettable evening at our Grand Opening Party, where sophistication meets celebration.

Opening Keynote

| Speaker(s): |

| - Bertrand RAMBAUD - Chairman | FRANCE INVEST |

| Moderator(s): |

| - Antoine COLSON - CEO and Managing Partner | IPEM |

| - Emmanuelle DUTEN - Events Manager | CAPITAL FINANCE |

Access exclusive findings from the annual pan-European PE survey.

Organized by IPEM since 2018, with the support of 14 national private equity associations, this mood of European GPs for the coming year allows you to discover the risks, opportunities, and key trends on the investment and fundraising side, with a particular focus on "Getting Deals Done" in 2024.

The 43-question online survey was conducted from November 9 to December 12, 2024 among a representative sample of 157 European GP's.

| Speaker(s): |

| - Nicolas BEAUGRAND - Partner & Managing Director | ALIXPARTNERS |

| - Antoine COLSON - CEO and Managing Partner | IPEM |

A deeper look at firms that have taken innovative approaches to origination.

| Speaker(s): |

| - Andrew SILLITOE - Partner, co-CEO | APAX |

| Moderator(s): |

| - Swetha GOPINATH - Private Equity Deals Reporter | BLOOMBERG NEWS - LONDRES |

Fireside chat

In conversation with prolific acquirers who execute buy-and-build as a strategy for growth. How does one manage execution risk in the current environment?

| Speaker(s): |

| - Laurent MIGNON - Group CEO | WENDEL GROUP |

| Moderator(s): |

| - Emmanuelle DUTEN - Events Manager | CAPITAL FINANCE |

The private equity M&A market gets a healthcheck from one of the region’s top bankers.

| Speaker(s): |

| - Sophie JAVARY - Vice Chairman CIB EMEA | BNP PARIBAS |

Panel

As the market shakes off the winter blues, this panel will conduct a healthcheck on the state of deal markets across a range of PE strategies.

| Speaker(s): |

| - Michael ELIO - Partner | STEPSTONE GROUP |

| - Stéphane ETROY - Partner & Head of European Private Equity | ARES MANAGEMENT |

| - Mark MCDONALD - Managing Director | BROOKFIELD |

| - Jan STÅHLBERG - Founder and Managing Partner | TRILL IMPACT |

| Moderator(s): |

| - Swetha GOPINATH - Private Equity Deals Reporter | BLOOMBERG NEWS - LONDRES |

Panel

For private equity, part of the appeal of private credit is that they speak the same language. Yet the ascendancy of private credit has now created an interesting dynamic with equity counterparts. What are we seeing with regards new money terms? Knowing what sponsors know about the asset class, what is their view of inflation-driven pricing? What flexibility is being offered for challenging credits?

| Speaker(s): |

| - Carmen ALONSO - Head of UK & Iberia | TIKEHAU CAPITAL |

| - Amit BAHRI - Co-Head of European Direct Lending | GOLDMAN SACHS ASSET MANAGEMENT |

| - Nael KHATOUN - Managing Director and Portfolio Manager, European Private Debt | OAKTREE CAPITAL MANAGEMENT |

| - Appu MUNDASSERY - Portfolio Manager | DB INVESTMENT PARTNERS |

| Moderator(s): |

| - Francesca FICAI - Senior Editor | PITCHBOOK – LCD |

Panel

A new valuation paradigm had caused exits to grind to a halt. What is the approach to exit planning – and has it changed to meet this new reality? Can LPs expect longer holidng periods – and if so, what is the impact on returns and liquidity?

| Speaker(s): |

| - Andrea BONOMI - Chairman | INVESTINDUSTRIAL |

| - Gilbert KAMIENIECKY - Head of Private Equity Technology | INVESTCORP |

| - Ryan MASHINTER - Senior Managing Director | ONEX |

| - Thomas VATIER - Partner, Head of Direct Private Equity | QUILVEST CAPITAL PARTNERS |

| Moderator(s): |

| - Sunaina SINHA - Global Head of Private Capital Advisory | RAYMOND JAMES |

Fireside Chat

In this on-stage conversation, we explore why, despite private capital being a dominant source of financing for companies, there remains room for growth in Europe. How will the industry simplify access to European opportunities? How will platforms and independent managers both play a role?

| Speaker(s): |

| - Christophe BAVIÈRE - Co-Chief Executive Officer | EURAZEO |

| Moderator(s): |

| - Sebastian MCCARTHY - Reporter | DOW JONES |

Panel

The growth capital funding gap is keeping the region’s financiers awake at night. Attempts to mobilise institutional capital has become a matter of digital sovereignty. The aim is to close the gap for late-stage companies that currently prompts them to seek funding abroad. What are the views of investors on the ground about the state of European late-stage financing?

| Speaker(s): |

| - Jan BRUENNLER - Managing Partner & Member of Investment Committee | BREGAL MILESTONE |

| - Christian RESCH - Partner | GOLDMAN SACHS ASSET MANAGEMENT |

| - Helen STEERS - Partner | PANTHEON |

| Moderator(s): |

| - Frédéric COURT - Founder & Managing Partner | FELIX CAPITAL |

Panel

Strategic acquirers are re-imagining their relationship with private equity. With alternative structures around disposals, minorities and venture programmes, are more creative deals with corporates now the norm?

| Speaker(s): |

| - Jean-Luc ALLAVENA - Chairman & Founder | ATLANTYS INVESTORS |

| - Saam GOLSHANI - Partner | WHITE & CASE |

| - Sebastien KIEKERT LE MOULT - Managing Partner | SYNTAGMA CAPITAL |

| Moderator(s): |

| - Rachel LEWIS - Private Equity Reporter | MERGERMARKET |

Panel

New entrants and a flurry of investment has taken the French impact market to new heights. This session will explore what’s behind the uptick and the outlook.

| Speaker(s): |

| - Alexandre MARS - Founder & CEO | BLISCE/ |

| - Mathilde PAOLI - Partner | GENEO CAPITAL ENTREPRENEUR |

| - Aglaé TOUCHARD LE DRIAN - COMEX member of RAISE Group and Co-head of RAISE Impact | RAISE |

| Moderator(s): |

| - Yann LAGALAYE - Head of Ecological Transition and Impact | BNP PARIBAS ASSET MANAGEMENT - PRIVATE ASSETS |

Panel

With the region seeing strong fundraising and transaction activity in the healthcare space, this session will dig deeper into what makes Benelux so attractive.

| Speaker(s): |

| - Sascha ALILOVIC - Managing Partner | SHS CAPITAL |

| - Thierry CHIGNON - Managing Partner | MÉRIEUX EQUITY PARTNERS |

| - Sander SLOOTWEG - Managing Partner | FORBION |

| Moderator(s): |

| - Marc VAN VOORST TOT VOORST - Deputy Managing Director | NVP |

Panel

With inflation easing and modest growth expected, the outlook for the Italian economy may be brighter than many predicted. What do investors across the spectrum of private markets expect from the year ahead?

| Speaker(s): |

| - Roberto IPPOLITO - Managing Director & Head of Investment Team - Clessidra Private Debt Fund | CLESSIDRA |

| - Andrea PESCATORI - CEO | VER CAPITAL |

| - Luigi TERRANOVA - CEO | RIELLO INVESTIMENTI SGR |

| Moderator(s): |

| - Paule ANSOLEAGA ABASCAL - Managing Director Italy | ARCANO PARTNERS |

Panel

It’s been a tough year for deals in Spain, with activity down on previous years. What has been the experience of the panel in 2023 completing investments - and how do they view the year ahead?

| Speaker(s): |

| - Borja DEL OLMO - Founding Partner | AVIOR CAPITAL |

| - Alfonso ERHARDT - Founding Partner | OQUENDO CAPITAL |

| - Matilde HORTA E COSTA - Director Private Equity | ARCANO PARTNERS |

| Moderator(s): |

| - Lucía CAMBLOR - Senior Reporter | REORG LONDON |

Panel

Against a backdrop of stubborn inflation and the threat of recession, this panel of UK investors will share their perspective from the front line. What do they expect of the M&A market in 2024? What types of transactions are most likely to get done? Where do they see resilient opportunities?

| Speaker(s): |

| - Kirsty MCDONALD - Partner | GROWTH CAPITAL PARTNERS LLP (GCP) |

| - David MERRIMAN - Partner, Head of Private Debt | BEECHBROOK CAPITAL |

| - Kathryn POTHIER - Investor Relations Partner | EPIRIS |

| Moderator(s): |

| - Rachel LEWIS - Private Equity Reporter | MERGERMARKET |

-

Tech & Software - Industry Focus 10:00 AM / 12:15 PM – Summit Room 1 |

|

Introduction

Sponsored by WHITE & CASE

| Speaker(s): |

| - Emmie JONES - Partner | WHITE & CASE |

Panel

An industry at the crossroads

The evolution of private equity owners into tech subject matter experts has changed the landscape now for software businesses.

| Speaker(s): |

| - Chip BAIRD - Co-Founder and Managing Partner | GREYLION PARTNERS |

| - Thomas DE VILLENEUVE - Partner | SEVEN2 |

| - Harry DOLMAN - Partner | HPE GROWTH |

| - Anne-Charlotte PHILBERT - Investment Director - Growth | EURAZEO |

| Moderator(s): |

| - Emmie JONES - Partner | WHITE & CASE |

How LPs position themselves in the technology paradigm

Private equity’s hunger for digital opportunities has led to an explosion of ways in which LPs can gain exposure to the sector. How has this changed the game in technology allocation?

| Speaker(s): |

| - Daniel BALMISSE - Managing Partner | CATHAY CAPITAL |

| - Alain GODARD - Chairman & Managing Director | EUROPEAN FUND FOR DIGITAL SOVEREIGNTY |

| Moderator(s): |

| - Augustin PALLE - Vice President | QUADRILLE CAPITAL |

Panel

What venture firms are doing with a longer runway

The compounding effect of macro shocks has forced VC firms to reflect on building a more sustainable investment posture that is resilient to ongoing challenges.

| Speaker(s): |

| - Vianney BARRE - Partner | QUADRILLE CAPITAL |

| - Benoit FOSSEPREZ - General Partner | AXA VENTURE PARTNERS |

| - Mikael JOHNSSON - General Partner & Co-Founder | OXX |

| - Joshua BURCH - Cofounder and Managing Partner (GALLOS Technologies) | GALLOS TECHNOLOGIES |

| - Steve SCHLENKER - Managing Partner and Co-Founder | DN CAPITAL |

| Moderator(s): |

| - Guillaume VITRICH - Partner | WHITE & CASE |

Closing Remarks

| Speaker(s): |

| - Jérôme CHEVALIER - Founding Partner | QUADRILLE CAPITAL |

Infrastructure 10:00 AM / 12:45 PM – Summit Room 2 |

|

Welcome Coffee

Introduction

Sponsored by ACCURACY, AON, VAUBAN, WHITE & CASE

| Speaker(s): |

| - Christoph BRUGUIER - Senior Investment Director - Partner | VAUBAN INFRASTRUCTURE PARTNERS |

Panel

Industry dynamics - infra M&A outlook

The shift in capital flows into real assets, driven by sustainable transition and inflation-linked protection, has been seismic. What effect is that having on valuations, deal structures, terms and financing?

| Speaker(s): |

| - Christoph BRUGUIER - Senior Investment Director - Partner | VAUBAN INFRASTRUCTURE PARTNERS |

| - Nicolò CASTAGNA - Head of Infrastructure M&A - Southern Europe | AON M&A AND TRANSACTION SOLUTIONS |

| - Dimitar LAMBREV - Senior Portfolio Manager | UNIQA |

| - Ritter NICOLAS - Investment Director | INFRAVIA CAPITAL PARTNERS |

| - Giacomo ROSSI - Co-Founder & Partner | VESPER INFRASTRUCTURE PARTNERS |

| Moderator(s): |

| - François DUNOYER DE SEGONZAC - Partner | ACCURACY |

Strategy Roadshow

Core

| Speaker(s): |

| - Hugo SILVEIRA - Partner | TIIC |

| Moderator(s): |

| - Alexis HOJABR - Partner | WHITE & CASE |

Strategy Roadshow

Energy Infrastructure in Emerging Markets

| Speaker(s): |

| - Jaroslava KORPANEC - Partner and Head of Central and Eastern Europe, Energy Infrastructure | ACTIS |

| Moderator(s): |

| - Alexis HOJABR - Partner | WHITE & CASE |

Strategy Roadshow

Digital

| Speaker(s): |

| - Noi SPYRATOS - Managing Director, Private Infrastructure | CBRE INVESTMENT MANAGEMENT |

| Moderator(s): |

| - Alexis HOJABR - Partner | WHITE & CASE |

Strategy Roadshow

Infrastructure Debt

| Speaker(s): |

| - Berenice ARBONA - Head of Infrastructure Debt | LBP AM |

| Moderator(s): |

| - Alexis HOJABR - Partner | WHITE & CASE |

Strategy Roadshow

Energy Infrastructure in Europe

| Speaker(s): |

| - Peter SCHÜMERS - Partner and Co-Head of Investments | ENERGY INFRASTRUCTURE PARTNERS |

| Moderator(s): |

| - Alexis HOJABR - Partner | WHITE & CASE |

Strategy Roadshow

Growth Infrastructure

| Speaker(s): |

| - Prune DES ROCHES - Associée Andera Smart Infra | ANDERA PARTNERS |

| Moderator(s): |

| - Alexis HOJABR - Partner | WHITE & CASE |

Closing Remarks

| Speaker(s): |

| - Julien BAUDINAUD - Director | ACCURACY |

Deal Innovation 2:00 PM / 4:45 PM – Summit Room 1 |

|

Introduction

| Speaker(s): |

| - Jon WHITEAKER - Editor, The Drawdown | REAL DEALS MEDIA |

Panel

Taking a data driven approach to dealmaking

We live in a world where there has never been more data. Yet the traditional approach to private equity fails to harness the full potential. What can be achieved when private equity investing is redesigned around data-driven decisions?

| Speaker(s): |

| - Wittemann GERO - Co-Founder and Managing Partner | NEW PRIVATE EQUITY |

How Will AI impact the Private Equity Business

| Speaker(s): |

| - Jean SCHMITT - Président & Managing Partner | JOLT CAPITAL |

Innovation Showcase

Deal origination

In 20min spotlight sessions, we explore a new generation of dealmaking with the latest trends and innovations redefining how deals get done.

| Speaker(s): |

| - Hugo LE HOUARNER - CEO & Co-Founder | SEALK |

Innovation Showcase

Strategy

In 20min spotlight sessions, we explore a new generation of dealmaking with the latest trends and innovations redefining how deals get done.

| Speaker(s): |

| - Toledano DAVID - Partner | SINGULIER |

| - Rémi PESSEGUIER - Managing Director | SINGULIER |

Innovation Showcase

Distressed Real Estate

In 20min spotlight sessions, we explore a new generation of dealmaking with the latest trends and innovations redefining how deals get done.

| Speaker(s): |

| - Manuel ENRICH - Chief Investor Relations Officer | AHORA ASSET MANAGEMENT |

| - Ravi LACHMANDAS - Chief Investment Officer | AHORA ASSET MANAGEMENT |

Innovation Showcase

Cybersecurity

In 20min spotlight sessions, we explore a new generation of dealmaking with the latest trends and innovations redefining how deals get done.

| Speaker(s): |

| - Thomas HUTIN - Senior Managing Director & Head of Cybersecurity France | FTI CONSULTING |

Innovation Showcase

Geopolitics

In 20min spotlight sessions, we explore a new generation of dealmaking with the latest trends and innovations redefining how deals get done.

| Speaker(s): |

| - Jean-Renaud FAYOL - Founder and Managing Partner of Axis&Co | AXIS & CO |

| - Rym MOMTAZ - Consultant in Geopolitical Risk | AXIS & CO |

Closing Remarks

Portfolio Transformation 2:00 PM / 4:45 PM – Summit Room 2 |

|

Welcome Address

From value creation to portfolio transformation

In these times, transformation is the name of the game. Plain vanilla value creation strategies are experiencing both shrinking targets and higher competition dynamics. This opening address will make the case for why now the time is right for a bolder approach to value creation.

Sponsored by INDEFI

| Speaker(s): |

| - Marc DURANCE - Partner | INDEFI |

| - Emmanuel PARMENTIER - Managing Partner | INDEFI |

Building Resilience in Times of Change

| Speaker(s): |

| - Tayeh DAVID - Head of North America Private Equity | INVESTCORP |

| - Joanna KOCZUK - Head of IR | OXX |

| - Karsten LANGER - Managing Partner | THE RIVERSIDE COMPANY |

| Moderator(s): |

| - Imene MAHARZI - Senior Advisor | INDEFI |

Roundtables

Break

Case Study

Internationalisation

| Speaker(s): |

| - Audrey SOUSSAN - General Partner | VENTECH |

Case Study

Sustainability

| Speaker(s): |

| - Francois TRANIE - Partner | MEANINGS CAPITAL PARTNERS |

Roundtables

Wrap Up

Closing Remarks

IPEM / CHINA - Reveal 5:00 PM / 6:00 PM – Summit Room 1 |

Takeaways from IPEM / China

Live feedback from cross border key PE investment leaders & explore the opportunities in China.

IPEM / China took place 9-11 November 2023 in Wuxi, Jiangsu Province.

The international PE investment community and the key Chinese PE market players met during a 2-day networking program, drawing the future of cross border investment opportunities.

From success stories, economic and political policies to best in class thematic case studies (Green tech, new energy, healthcare, Tech…), let’s discover concrete deals and long-term collaborations that have emerged at the occasion of this very positive business momentum.

| Speaker(s): |

| - Gilles BARISSAT - Executive Chairman & Founder | IPEM |

| - Charles-Edouard BOUÉE - Co-Founder & Managing Partner | ADAGIA PARTNERS |

| - Thameur CHAGOUR - Managing Director | CAPSA CAPITAL PARTNERS |

| - François-Xavier COPÉ - Founding Partner | FIRST BRIDGE |

| - Jean-François COPÉ - Member of the Board of Directors | FPI |

| - Alexis DUPONT - Managing Director | FRANCE INVEST |

| - Nicolas ESCHERMANN - Member of the Executive Committee & Associate Director of Investors and Development | SIPAREX |

| - Jing LI - VP & Managing Director of International Business | LEGEND HOLDINGS |

| - HaiJiang MA - Group Investment Committee Member | WUXI CAPITAL GROUP CO.,LTD |

| Moderator(s): |

| - Nathalie DEPETRO - Global Strategy & New Bus. Development Director | EUROPEVENTS |

Sponsored by

Embark on an exclusive morning journey at our "LP Welcome Breakfast," a bespoke event meticulously designed for Limited Partners attending IPEM Cannes 2024. This breakfast is not just a meal; it's your gateway to a day of strategic insights, valuable connections, and tailored discussions within the private equity sphere. As an LP, you're invited to kickstart your event experience with a gourmet breakfast, setting the stage for meaningful interactions with industry peers and professionals.

Sponsored by

In partnership with

Delve into the heart of venture capital investments at our exclusive "LP Lunch: VC Focus," a dedicated event tailored for Limited Partners with a keen interest in the VC asset class. This unique gathering offers a rare opportunity to connect with like-minded LPs, share insights, and engage in discussions focused on the dynamic world of venture capital.

Elevate your experience with the special participation of 20 top VCs, carefully selected by our esteemed LP Committee. Whether you're a seasoned investor or exploring new opportunities, this event provides an intimate setting to cultivate relationships and explore the forefront of venture capital.

The New Manager Lunch is organized with vetted IPEM participants. It will be an opportunity for them to expand their reach.

Join the Dealmaker Game Night and support the Pétanque Competition!

Invitation-only event sponsored by

10 PM - 12 AM for invitees (open bar)

12 AM - 5 AM for all participants (cash bar)

Sponsored by

In partnership with

Opening Keynote

How constrained are portfolio allocations? What private equity sectors and geographies are they targeting? How important is ESG and Sustainability compared to their North American compatriots? What terms do they focus on in LPA negotiations? And what are their greatest fears in private equity?

| Speaker(s): |

| - Kelly DEPONTE - Managing Director | PROBITAS PARTNERS |

Panel

The narrative goes that more challenging market conditions shift the LP-GP relationship in favour of investors. What window do LPs have to move the needle? Where can LPs expect to make an impact? In practice, what have LPs walked away with during this market reset?

| Speaker(s): |

| - Anastasia AMOROSO - Chief Investment Strategist | ICAPITAL |

| - Bruno SOLLAZZO - Group Head of PE Investments | GENERALI |

| Moderator(s): |

| - Laura MERLINI - Managing Director, EMEA | CAIA ASSOCIATION |

To what extent are LPs able to tell a good deal from a bad one. When LPs look beyond fund performance, what do they see?

| Speaker(s): |

| - Ileana BOLCATO - Head of Group PE Portfolio Management & Lion River CEO | GENERALI |

| - Álvaro GONZÁLEZ RUIZ-JARABO - Managing Partner | BALIAN PRIVATE EQUITY |

| - Daniel KYLANDER - Investment Analyst - Private Equity | CHURCH COMMISSIONERS FOR ENGLAND |

| - Faisal RAFI - Global Head of Research | RISCURA |

| Moderator(s): |

| - William BARRETT - Managing Partner | REACH CAPITAL |

This session will present the results of an Armen HEC innovative initiative launched around sharing economic value. The session will address topics focused on carried interest, shares in the management companies and other long term incentive mechanism contributing to sharing value mechanisms in the industry.

| Speaker(s): |

| - Isabelle COMBAREL - Deputy Chief Executive Officer, Head of Business Development and ESG | SWEN CAPITAL PARTNERS |

| - Christophe DELDYCKE - CEO | TURENNE GROUPE - INNOVACOM |

| - Dominique GAILLARD - Executive Chairman | ARMEN |

There is a weight of institutional capital sat on the sidelines, waiting to be deployed into sustainable strategies. What is the experience investors in putting capital to work under this mandate?

| Speaker(s): |

| - Pascal CHRISTORY - Chief Executive Officer | AXA IM PRIME |

| - Guillaume D'ENGREMONT - Managing Director & Head of European Infrastructure | ICG |

| - Johnny EL HACHEM - Chief Executive Officer | EDMOND DE ROTHSCHILD PRIVATE EQUITY |

| Moderator(s): |

| - Tim HAMES - Advisor | ACUTI ASSOCIATES |

Panel

Investors may share many common concerns about the PE industry but often fail to communicate in a united front. What can investors do to find common ground and move the industry forward?

| Speaker(s): |

| - Gaetan AVERSANO - Deputy Head of Private Markets | UBP - UNION BANCAIRE PRIVÉE |

| - Carolin BLANK - Managing Director | HAMILTON LANE |

| Moderator(s): |

| - Carmela MENDOZA - Senior Reporter | PRIVATE EQUITY INTERNATIONAL |

Panel

The transition to deeper relationships with fewer managers is already underway for many LPs. How do investors execute on this plan? What are the risks of this strategy? What approaches do they deploy to reconfigure relationships as partnerships? When do you decide to build in-house capability?

| Speaker(s): |

| - Ben WALLWORK - Partner, Co-Investments | ADAMS STREET PARTNERS |

| - Cyrille FLICHY - Head of Private Equity Investments | BANQUE CANTONALE DE GENEVE |

| - Mateusz MILEWSKI - Head of Private Equity Department | PZU |

| Moderator(s): |

| - Greg CIESIELSKI - Managing Director | HARBOURVEST PARTNERS |

Panel

Quasi dealmakers themselves, family offices are renowned for being nimble, agile and flexible providers of capital in their own right. What’s their view about the right balance between fund and direct opportunities? How do they assemble competency on both fronts? Where do family offices have an edge?

| Speaker(s): |

| - Roy AWAD - Managing Partner | WHITE PEAKS CAPITAL |

| - Nancy CURTIN - Global Chief Investment Officer | ALTI TIEDEMANN GLOBAL |

| - Andrew HARRISON - Partner, Head of Capital Formation | PERWYN |

| Moderator(s): |

| - Frederick CROT - President | AFFO - ASSOCIATION FRANÇAISE DU FAMILY OFFICE |

Panel

The industry is on a mission to make private assets accessible to all. But, while enticing, is the prospect of rebranding private markets as a retail investment opportunity a mirage? This session will explore the hurdles that still face the sector, as well as the experiences of those managers that are successfully opening the doors to a new world.

| Speaker(s): |

| - Gorka GONZALEZ - Head of Retail Business | BPIFRANCE |

| - Maurice TCHENIO - Co-Founder | ALTAMIR |

| - Hannah WALLIS - Co-Head of Multi Alternative Strategy EMEA | BLACKROCK |

| Moderator(s): |

| - Montserrat FORMOSO - Editor & Senior Analyst | FUNDS PEOPLE |

Panel

Against a backdrop of lower distributions and longer holding periods, continuation funds have become a hot topic for investors. How is the marketing getting comfortable with valuations, managing conflicts and the future potential of these vehicles?

| Speaker(s): |

| - Marion COSSIN - Managing Director Private Capital Advisory | LAZARD |

| - Bernhard ENGELIEN - Managing Director, Co-Head of Private Capital Advisory Secondaries | GREENHILL & CO. INTERNATIONAL LLP |

| - Michal LANGE - Partner, Co-Head GP-Equity Solutions | ASTORG |

| - Kristof VAN OVERLOOP - Managing Director | FLEXSTONE PARTNERS |

| Moderator(s): |

| - Matthew CRAIG-GREENE - Director | WAGTAILS PRIVATE MARKETS |

An exploration into the possibilities that data can provide. What is the potential of a data-driven LP? How do you get access to the right data? How do you take better decisions based on it? How do you know you can trust it?

| Speaker(s): |

| - Manuel DEIMEL - Managing Director | YIELCO INVESTMENTS AG |

| - Vaish KATAMREDDY - Director, Investments | GOLDING CAPITAL PARTNERS |

| Moderator(s): |

| - Olivia ZITOUNI - Group Head of Coverage & Business Development PERES | CACEIS |

From the perspective of an investor in GPs, this session will look at the themes driving the evolution of the GP landscape, how the winners will survive and the future partnerships that LPs should be building.

| Speaker(s): |

| - Paul DE LEUSSE - Group CEO | SIENNA INVESTMENT MANAGERS |

| - Antoine DUPONT-MADINIER - Managing Director | LINCOLN INTERNATIONAL |

| Moderator(s): |

| - Antoine COLSON - CEO and Managing Partner | IPEM |

-

IPEM / North America - Reveal 9:00 AM / 9:30 PM – Summit Room 2 |

|

In partnership with

| Speaker(s): |

| - Catalina BASAGUREN - International Business Development | IPEM |

| - Antoine COLSON - CEO and Managing Partner | IPEM |

| - Nikki PIRRELLO - President | PENSIONS & INVESTMENTS |

Healthcare - Industry Focus 10:00 AM / 12:45 PM – Summit Room 1 |

|

Welcome Coffee

Opening address

Healthcare - both a sector and a theme for private asset managers

Sponsored by HBI, INDEFI and TECHLIFE CAPITAL

| Speaker(s): |

| - Nicolas LAMOUR - Partner | INDEFI |

| - Emmanuel PARMENTIER - Managing Partner | INDEFI |

The intersection of technology and healthcare

| Speaker(s): |

| - Grégoire CAYATTE - Managing Partner | TECHLIFE CAPITAL |

Panel

The 2024 outlook for healthcare investments

| Speaker(s): |

| - Chiara BRAMBILLASCA - | PICTET |

| - Ricardo DE SERDIO - Chairman & CEO | FREMMAN CAPITAL |

| - Rudy DEKEYSER - Partner & Head of Health Economics Funds | EQT |

| - Holger ROSSBACH - Co-Head Private Equity & Venture Capital | PALLADIO PARTNERS |

| Moderator(s): |

| - Nicolas LAMOUR - Partner | INDEFI |

Strategy Roadshow

Growth Investing

| Speaker(s): |

| - Jacques ROSSIGNOL - Managing Partner | TECHLIFE CAPITAL |

| Moderator(s): |

| - Lee MURRAY - Events Director | HEALTHCARE BUSINESS INTERNATIONAL |

Strategy Roadshow

Healthcare services

| Speaker(s): |

| - Jim WEIGHT - Managing Partner | WEIGHT PARTNERS CAPITAL LLP |

| Moderator(s): |

| - Lee MURRAY - Events Director | HEALTHCARE BUSINESS INTERNATIONAL |

Strategy Roadshow

Pharma services

| Speaker(s): |

| - Amit KARNA - Senior Director | KEENSIGHT CAPITAL |

| Moderator(s): |

| - Lee MURRAY - Events Director | HEALTHCARE BUSINESS INTERNATIONAL |

Strategy Roadshow

Discovery

| Speaker(s): |

| - Christian JUNG - Partner | DEMENTIA DISCOVERY FUND |

| Moderator(s): |

| - Lee MURRAY - Events Director | HEALTHCARE BUSINESS INTERNATIONAL |

Strategy Roadshow

Late Stage

| Speaker(s): |

| - Rafaèle TORDJMAN - Founder & CEO | JEITO CAPITAL |

| Moderator(s): |

| - Lee MURRAY - Events Director | HEALTHCARE BUSINESS INTERNATIONAL |

Closing remarks

Secondaries 10:00 AM / 12:30 PM – Summit Room 2 |

|

Welcome Coffee

Introduction

Sponsored by PREQIN

| Speaker(s): |

| - Rachel DABORA - Research Analyst — London | PREQIN |

Keynote

Market Outlook

Crystal balls at the ready. This on-stage conversation will crunch the numbers on the big trends of the past twelve months and make some predictions about what to expect from the year ahead.

| Speaker(s): |

| - Louise BOOTHBY - Partner | CVC |

| - Marion PEIRIDIER - Managing Director | FIVE ARROWS MANAGERS |

| Moderator(s): |

| - Annabelle JUDD - Managing Director | CAMPBELL LUTYENS |

Panel

Key Considerations to Futureproof a Secondaries Programme

Once a niche, secondaries has now gone mainstream. This proliferation is giving investors pause for thought, with more time spent screening transactions and designing programmes that meet their specific needs. As the GP and LP markets diverge, what skillsets are having to be developed in-house and with external managers to capitalise on growth in the market? What does a secondary programme of tomorrow look like? What innovation is happening that investors should be aware of?

| Speaker(s): |

| - David ENRIQUEZ - Partner | CLIPWAY |

| - Chrissy LAMONT SVEJNAR - Partner, Secondaries | ARES MANAGEMENT |

| - Jérôme MARIE - Managing Director, ODDO BHF Private Equity | ODDO BHF |

| - Diana MEYEL - Managing Partner | CIPIO PARTNERS |

| - ALEX SHIVANANDA - Partner | CAMBRIDGE ASSOCIATES |

| Moderator(s): |

| - Philippe FERNEINI - Partner | STEPSTONE GROUP |

Panel

Venture Secondaries – the Market’s Best Kept Secret?

This panel will examine what’s behind the meteoric rise in popularity of venture secondaries. From views on pricing, buyer and seller characteristics and market drivers, participants will leave with an understanding about how and why VC can play a part in a secondaries programme.

| Speaker(s): |

| - Alejandra DURAN GIL - Partner | QUADRILLE CAPITAL |

| - Michael JOSEPH - CEO | ION PACIFIC |

| - Olav OSTIN - Managing Partner | TEMPOCAP |

| Moderator(s): |

| - Gilles MOREL - Managing Director | JASMIN CAPITAL |

Closing Remarks

Private Debt 2:30 PM / 5:00 PM – Summit Room 1 |

|

Welcome Coffee

The Current State of ESG Integration in European Private Credit

| Speaker(s): |

| - Stuart FIERTZ - Founder & President | CHEYNE CAPITAL |

| - Xavier LEROY - Member of the Executive Committee - Head of Advisory Services | ETHIFINANCE |

Panel

Risks to Watch out for in Private Debt’s Crowning Moment

Investors have been shifting allocations into private credit in anticipation of interest rate rises. Now is the asset class’s time to shine. Returns, fundraising and an expanding opportunity set are all tailwinds for future growth – but what are the risks?

| Speaker(s): |

| - Guillaume CHINARDET - Deputy Head of Private Credit & Senior Managing Director | ARDIAN |

| - Francesco DI VALMARANA - Partner | PANTHEON |

| - Cecile MAYER LEVI - Head of Private Debt | TIKEHAU CAPITAL |

| - Edouard NARBOUX - President | AETHER FINANCIAL SERVICES |

| Moderator(s): |

| - Pierre-Antoine GODEFROY - Managing Director | CAMPBELL LUTYENS |

Strategy Roadshow

Mezzanine

| Speaker(s): |

| - Richard DALAUD - Membre du Comité Exécutif - Partner Siparex Mezzanine | SIPAREX |

| Moderator(s): |

| - Gabriella KINDERT - Non Executive Director | Board Member | MILAREC |

Strategy Roadshow

Junior Capital

| Speaker(s): |

| - Antoine LOURTAU - Partner & Head of France | PARK SQUARE CAPITAL |

| Moderator(s): |

| - Gabriella KINDERT - Non Executive Director | Board Member | MILAREC |

Strategy Roadshow

Lower Mid Market

| Speaker(s): |

| - Klaus PETERSEN - Founding Partner | APERA ASSET MANAGEMENT LLP |

| Moderator(s): |

| - Gabriella KINDERT - Non Executive Director | Board Member | MILAREC |

Strategy Roadshow

Preferred Equity

| Speaker(s): |

| - Beatrice TAMBURI - Partner - Head of Business Development Italy | THREE HILLS CAPITAL PARTNERS |

| Moderator(s): |

| - Gabriella KINDERT - Non Executive Director | Board Member | MILAREC |

Closing Remarks

Energy Transition - Industry Focus 2:30 PM / 4:45 PM – Summit Room 2 |

|

Welcome Coffee

Fireside Chat

What Are the Key Obstacles to Progress?

An overview of the state of energy transition investing in private markets – what progress is being made and where is it falling short?

| Speaker(s): |

| - Pierre ABADIE - Managing Director & Group Climate Director | TIKEHAU CAPITAL |

| - Isabelle COMBAREL - Deputy Chief Executive Officer, Head of Business Development and ESG | SWEN CAPITAL PARTNERS |

| Moderator(s): |

| - Nicolas BEAUGRAND - Partner & Managing Director | ALIXPARTNERS |

What are the experiences of LPs?

Jean-Philippe and Ferdinand join the conversation the room for a segment that involves audience contributions around the practical experiences that LPs have allocating to net zero strategies – maximised returns, fiduciary duty, duration.

| Speaker(s): |

| - Ferdinand DALHUISEN - Managing Director, ODDO BHF Private Equity | ODDO BHF |

| - Jean-Philippe RICHAUD - Deputy CEO & CIO of Multi-strategy activity | SWEN CAPITAL PARTNERS |

| Moderator(s): |

| - David DANA - Head of VC Investments | EIF - EUROPEAN INVESTMENT FUND |

Break

Panel

What are the Solutions?

The goals and timeline for net zero are clear – so why is so much capital waiting on the sidelines? Based upon the obstacles that were outlined in the prior two sessions, the panel will examine the catalysts for change.

| Speaker(s): |

| - Stéphanie BÉGUÉ - Partner – Head of Business Development & Investor Relations | RGREEN INVEST |

| - Jessica PETERS - Head of ESG | ARGOS WITYU |

| - Michel-André VOLLE - Global Head Investor Relations & Funding Solutions | MERIDIAM |

| Moderator(s): |

| - Yuebing LU - Venture Partner | B CAPITAL |

Closing Remarks

Sponsored by

Elevate your morning routine at our exclusive "Wealth Management Breakfast" event. Delight in a gourmet breakfast while immersing yourself in strategic insights from industry leaders. Network with fellow professionals in the private wealth sector, and experience a tailored morning of connections and valuable discussions, all set against the backdrop of a sophisticated and collaborative environment. Whether you're savoring flavors or sowing the seeds of financial success, this breakfast is your key to a thriving day ahead.

Invitation-only event in partnership with

Private Equity supporting the ecological and digital transition in Africa

Cannes, January 25, 2024 (8:30 - 10 AM)

Breakfast - JW Marriott

8:30 to 8:35 AM | Welcome by Antoine COLSON, CEO and Managing Partner of IPEM

8:35 - 8:40 AM | Introductory Remarks by Serge DEGALLAIX, General Manager of the Fondation Tunisie pour le Développement (Tunisia Foundation For the Development).

8:40 - 9 AM | Africa, Transitions and Private Equity

9 - 9:40 AM | Tunisia, a Key Local and Regional Player in PE and Transition Financing

Session 1: Digital Transition: Tunisia, a Land of Investment and Offshoring

Session 2: Climate Transition: Towards a New Investment Fund?

9:40 - 9:55 AM | Discussions with the Audience

9:55 - 10 AM | Conclusions by Jean-Michel SEVERINO (I&P)

Sponsored by

Supported by

Celebrate empowerment and collaboration at our "Women Dealmaker Lunch," an exclusive gathering that transcends boundaries and fosters meaningful connections. Join accomplished women dealmakers for a curated luncheon where expertise meets inspiration. Engage in insightful conversations, share experiences, and forge new professional alliances in an environment designed to highlight the achievements of women in the dealmaking arena. Whether you're a seasoned professional or emerging talent, this luncheon is an opportunity to thrive in a supportive community while enjoying a delectable meal.

Sponsored by

Indulge in an exclusive culinary experience at our "Single Family Office Lunch." Join discerning individuals from the private wealth management sector for an intimate gathering that goes beyond the boardroom. This lunch is meticulously curated for Single Family Offices, providing a platform for networking, thought-provoking discussions, and the exchange of valuable insights. Whether you're navigating complex financial landscapes or seeking collaborative opportunities, this event is your invitation to connect with like-minded professionals in a sophisticated and convivial setting.

Celebrate the culmination of a successful event at our "Aftermatch Cocktail," the grand finale where connections made, insights gained, and memories created converge in a toast to success. Join us for an evening of camaraderie, reflection, and networking as we bid farewell to another remarkable event. Whether you're wrapping up deals or simply savoring the moments, this cocktail is the perfect setting to unwind, mingle with industry peers, and enjoy a relaxed atmosphere. Raise a glass to the achievements of IPEM Cannes 2024 and the promising paths that lie ahead.

Aligned with our 10th edition theme “Getting Deals Done”, dealmaking is at the heart of the IPEM Cannes event (check the program and book sessions with the puzzle badge 🧩).

Meet with 16 exhibiting M&A firms: Allinvest Corporate Finance, BNP Paribas, CFI France – Athema, Clairfield International, Credit Agricole CIB, Financiere De Courcelles, Greenhill & Co. International, HSBC, In Extenso Finance, Lazard, Lincoln International, Natixis Partners, Neuflize OBC, Oaklins, Oddo BHF, Société Générale CIB (check who is coming to the event).

Alongside networking lounges and social events, we have imagined a dedicated area (check the Floorplan) for the first time this year! (M&A only can book a timeslot in a meeting room via the IPEM Account).

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.