Deep dives with the IPEM Community

During IPEM Cannes | Wealth 2025, we asked Private Markets experts from around the globe to share some industry insights by answering a few questions…

IPEM, International Private Equity Market, is the premier relationship broker for global private equity. IPEM Events are world renowned for bringing together the industry’s leading investors, allocators, advisors, and service providers allow to Its dynamic business format is designed to drive innovation and shape the debate across private markets, delivered in a way that champions ESG responsibility. Below are some key insights on impact investing that came out of our last two events.

For years, ESG was viewed as a mere checkbox—an obligation rather than an opportunity. However, that perception is shifting rapidly. Private equity firms across Europe are increasingly recognizing that sustainability is no longer a niche investment theme, but a key driver of value creation, competitive advantage, and long-term resilience.

As governments enforce aggressive decarbonization targets and industries face mounting pressure to transition, private capital is being called upon to bridge the funding gap and support portfolio companies in adopting more sustainable models. The role of private markets in financing energy infrastructure, industrial transformation, and climate-tech innovation is growing, and firms that fail to integrate sustainability into their investment strategies risk being left behind. The influence of private equity funds on the strategies of their portfolio companies and on the economy is well understood, and their stewardship strategies are becoming central to theis value creation efforts.

Europe is at a pivotal moment in its quest to regain global competitiveness and resilience, with the energy transition and energy independence playing a central role in this effort. However, the continent faces a significant funding gap in financing the transition, and private markets are increasingly seen as a critical solution. While public markets have faced challenges in efficiently directing capital toward climate investments, private capital is stepping in with long-term, strategic investments to bridge the gap. The urgency is not just ecological—it is economic, as Europe strives to strengthen its competitive position on the global stage.

Key figures underscore the urgency:

🟢 Europe’s energy transition alone requires hundreds of billions in annual investment, with a pressure on private capital to play a vital role in bridging the financing gap.

🟢 Renewable energy production in Europe has increased from 10% in 2005 to 25% in 2025, with a target of 40% by 2030. This will require €600 billion in investment over the next five years. Achieving this goal demands rapid infrastructure development and industrial decarbonization.

🟢 Energy costs in Europe remain significantly higher than in the U.S.: 1 MWh costs 50% more, and fuel prices can be up to four times higher. This disparity is impacting industrial competitiveness and highlighting the need for enhanced energy security.

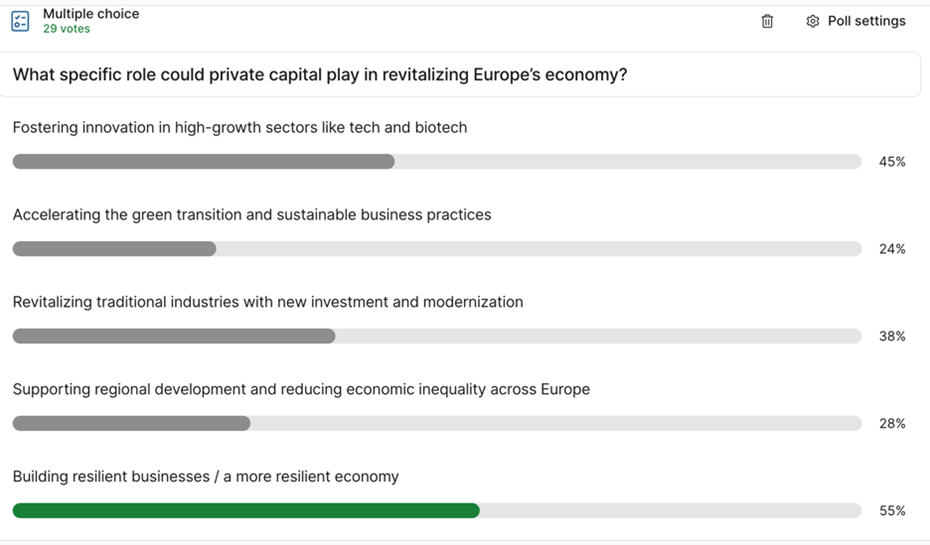

A live poll conducted during the IPEM event revealed that the attendees’ primary expectation of private equity regarding the European economy is to help enhance its resilience.

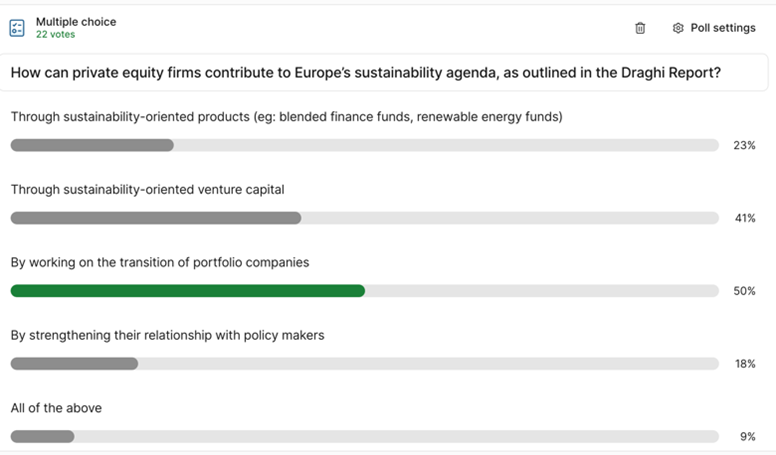

Private equity’s role in supporting Europe transition to a more sustainable model is a much a funding role than a transformational one. While the funding gap may seem the most urgent and visible issue, a live poll conducted at IPEM on how private equity could contribute to Europe’s sustainability agenda as outlined in the Draghi report revealed that the industry sees its primary role in stewardship and portfolio transition efforts.

Stewardship practices have been a key element of sustainability strategies for listed asset managers for several years and are now gaining traction in the unlisted space. Transparent stewardship strategies that result in the transformation of portfolio companies are not only beneficial to the broader economy but also serve as a key differentiator, positioning private equity firms that adopt them as sustainability leaders.

Private equity is uniquely positioned to accelerate the industrial and energy transition by funding commercially viable, scalable solutions rather than speculative green-tech ventures dependent on subsidies:

🟢 Mid-market PE firms are particularly active in financing industrial efficiency improvements, sustainable manufacturing, and energy resilience solutions.

🟢 Structured credit and private debt are emerging as alternative financing tools, allowing large-scale energy projects to access capital beyond traditional equity.

🟢 VC funding for climate-tech startups remains crucial, but Europe still struggles with late-stage financing and commercialization, despite boasting twice as many climate-tech startups as the U.S. (30,000 vs. 14,300).

The conversation at IPEM underscored that sustainability-driven investments must be commercially viable, rather than relying on subsidies, policy incentives, or green premiums. A key takeaway from climate-focused funds: “We don’t count on politicians or regulation. Our investments must return capital based on market demand, not policy-driven advantages.”

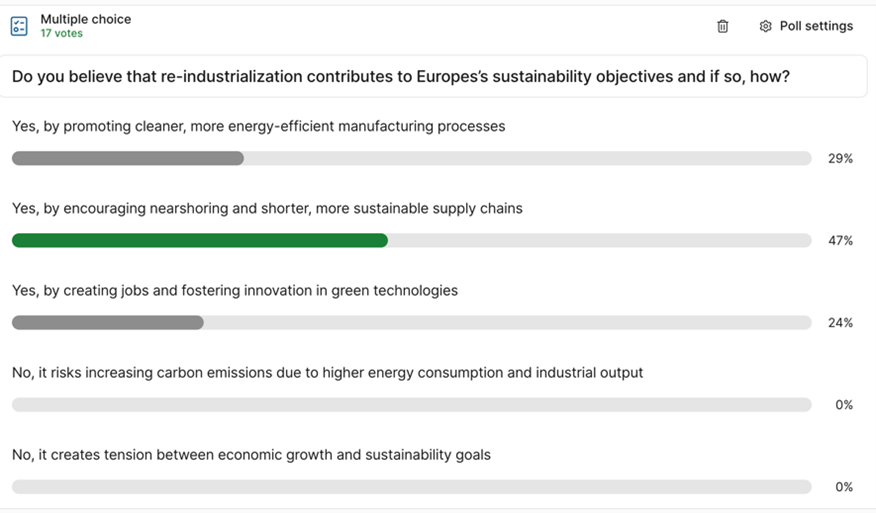

A live poll surveyed the audience on the connection between re-industrialization and sustainability objectives. The results showed that 100% of respondents saw a positive correlation, with 47% believing it was tied to encouraging nearshoring and the development of shorter, more sustainable supply chains.

Industrial players and LPs are recognizing the cost of inaction, as climate policies are increasingly driven by science-based targets rather than political agendas.

While the momentum for sustainable investing is growing, several challenges persist:

🟢 From ESG commitment to measurable transition plans : Three years ago, 90% of companies didn’t measure carbon footprints—now, 50% are aligned to net-zero pathways. This was the easy part. Now we enter a more complicated phase which is to allocate CapEx for deep transition.

🟢 Meeting regulatory requirements and fulfilling LPs reporting expectations: Companies must balance compliance with regulatory demands and reporting expectations without losing sight of their long-term strategic goals.

🟢 Funding and Exit Complexity:

• Despite a strong pipeline of climate-tech startups, late-stage funding gaps remain a major bottleneck in Europe.

• PE-backed industrial transitions require significant CapEx, making financing structures and exit strategies more complex.

• The exit environment for sustainability investments is strengthening, but firms must focus on superior technology and clear economic benefits rather than relying on green premiums.🟢 Regulatory Uncertainty and Market Fragmentation: Europe’s sustainability policies remain highly fragmented across jurisdictions, creating uncertainty for investors. The lack of harmonized incentives and policy frameworks complicates long-term investment planning.

Sustainability is no longer just about compliance—it is a strategic pillar for future growth. PE firms that integrate sustainability effectively will gain a competitive edge, while those that lag behind will pay a premium to catch up. The key question for private equity in 2025 and beyond is not whether sustainability matters, but how to integrate it into investment strategies without compromising returns.

Some trends are showing, and while they are not new, they tend to get stronger by the year:

🟢 LPs are increasingly aligning capital allocation with ESG performance, pushing funds to adopt transparent, measurable sustainability targets.

🟢 Sector leaders are shifting their strategies toward sustainability-driven industrial and infrastructure deals.

🟢 Mid-market funds have an advantage in executing targeted, high-impact transitions within their portfolios.

Europe’s transition to a sustainable economy is happening—with or without private equity. The question is: will PE firms capitalize on this transformation, or will they be forced to adapt later at a higher cost?

Article written in collaboration with Alamada Sustainability Advisory

During IPEM Cannes | Wealth 2025, we asked Private Markets experts from around the globe to share some industry insights by answering a few questions…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to watch the Infrastructure Summit Replay.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to watch the Private Debt Summit Replay.

Fill in the information below to watch the Webinar Replay.

Fill in the information below to download the LP Package.

Fill in the information below to watch the Climate Investing Summit Replay.

Fill in the information below to download the Factsheet.

Fill in the information below to hear the full podcast.

Fill in the information below to hear the full podcast.

Fill in the information below to hear the full podcast.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to watch the Venture & Growth Summit Replay.

Fill in the information below to watch the Impact Summit Replay.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.