IPEM Cannes 2024 – The Daily Spin – January, 25th

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

European growth capital had a particularly strong year in 2022. According to Invest Europe, it was the best-performing segment, generating a net IRR of 15.34%. Over a three- and five-year period, European growth funds – which typically take minority stakes in high growth firms that are cashflow positive yet lack a long enough track record to take on significant debt (as one would see in buyouts) – have generated 21.63% and 20.39%.

Can European growth equity kick on in 2024?

Growth equity occupies the middle ground between VC and buyouts. With higher financing costs putting the brake on LBOs (M&A deals totaled $393 billion through Q3 2023, down 41%), and concerns over valuations stymying VC deal activity, growth equity has not been able to avoid the prevailing headwinds that have made 2023 a challenging year for fundraising.

According to Invest Europe’s Investing in Europe Private Equity Activity H1 2023 report, through the first half of the year, growth equity funds raised EUR4.7 billion; approximately half the amount raised in H2 2022 (EUR9.5 billion) and nearly 2.5 times less than the amount raised in the same period last year (EUR11.2 billion).

How growth equity investors approach dealmaking in 2024 will depend, to some extent, on whether VC and buyout activity picks up. Not that Europe is lacking in terms of opportunity set, or firms ready to deploy capital.

Alongside Sweden and Germany, the UK is regarded as a leading hotspot for growth equity. Indeed, the UK’s Business Growth Fund is one of Europe’s most active growth equity investors, completing 152 deals since 2018.

As Europe’s venture capital industry continues to mature, so too is the growth equity marketplace. A Pitchbook ranking of the fastest-growing VC markets places Europe in a positive light, with Berlin ranked third. Madrid, Milan, Tallinn, and Vienna occupied the last four spots in its top 10 list.

Firms like Lyon-based Siparex Group, London-based Foresight Group, and Paris-based Capza are only too willing to strike deals and provide growth stage capital to companies they believe have the potential to become unicorns (EUR1 billion valuations). Capza announced this month (15th December) that one of its investee firms, Efor Group, a life sciences consulting firm, was joining forces with Nodarius. The strategic alliance is the next step in Efor Group’s growth strategy as it aims to become a global leader by 2028.

The panel session “Investing in the different shades of European growth capital” during the afternoon of Day 1 (24th Jan) at IPEM Cannes 2024 will provide up-to-date insights on how PE firms are thinking about their investment pipeline, and where they see the best deals coming to light, as they look to put capital to work.

Primed to Shine

Investment firms like Chicago-based Adams Street Partners are bullish on the outlook for growth equity. In their view, while the supply of growth capital outweighed demand in late 2020, leading to sky-high valuations, that imbalance has now reversed “so that today – and, in our opinion, likely for the foreseeable future – demand for growth capital far outweighs supply.”

As firms prepare to raise capital again, having tapped into their cash reserves for as long as possible, there is a sense that this could provide favorable conditions for managers to strike deals at fair valuations.

While the dealmaking and fundraising environment has felt the strain over the last 12 months, there are bright spots.

French growth equity VC firm, Revaia, founded by Alice Albizzati and Elina Berrebi, recently announced a first close of EUR150 million for their second fund. This comes on the back of successfully raising EUR250 million for their first fund two years ago and proves that a team’s pedigree can overcome any challenging market. Moreover, this positions Revaia as Europe’s largest female-founded growth fund.

Blume Equity, one of Europe’s leading climate tech growth funds focused on transitioning to a low-carbon economy, is illustrative of how growth equity firms can benefit from wider structural trends. In September 2023, the European Investment Fund (EIF), with support from InvestEU, confirmed it was investing EUR40 million in Blume Equity, joining an investor base that includes Visa Foundation, Impact Engine (a US impact FoF program), and AP4, the Swedish National Pension Plan. This is the largest investment EIF has made to a first-time growth fund.

Consumer tech appeal

At General Atlantic, the US growth equity specialist, one sector of interest for further growth and investment is consumer tech.

Research by its Growth Acceleration team indicates that while 68% of current subscription spending is concentrated in media & entertainment, it is widening out to areas including gaming, fitness, and health/wellness. As they point out in the research piece, “over the next three years, consumers expect annual spending on subscriptions to increase by 33%, from $621 to $829. While media helped pave the way for paid subscriptions, many verticals remain underpenetrated.”

While consumer-focused subscription models share similar features to B2B software subscription models, General Atlantic points out that they often have more attractive metrics.

Carving the next masterpiece?

Corporate carve-outs/spin-offs could also prove to be a useful deal generator for PE groups in 2024, especially those who are running mid-market strategies. This will be the subject of a deep-dive discussion – “Hunting for carve-outs” – at IPEM Cannes 2024.

Mid-market firms such as Abris Capital have successfully completed spin-offs in the past but as Pawel Gierynski, Managing Partner, explains: “I am of the view that this type of transaction should be a complement to our investment pipeline, rather than its core, because these opportunities are usually available at the bottom of the macro cycle.”

“We remain open to considering interesting spin-offs, but it is unlikely we will invest significant resources in the systematic and long-term sourcing of this type of transaction.”

Recessionary risks, shrinking profit margins and the higher cost of debt are all factors that could sway firms to trim the fat and sell non-core assets. To capitalize on the right opportunities, however, will require PE firms to be creative with their deal strategies. A recent Bain & Company report stated: “We anticipate more carve-outs as firms refocus in a downturn and unlock cash for strategic priorities within their core.”

Yellow Wood Partners, a consumer-focused PE group, has made a binding offer for Elida Beauty, as Unilever allows some of its brands to be carved out. While Kohler & Co, a maritime power systems and engine manufacturer has decided to carve out its energy business (Kohler Energy) with the support of Platinum Equity. The US private equity firm, which has $47 billion in AUM and a track record of successful carve-outs, will become the majority investment partner.

In Europe, Inflexion announced on December 21st 2023 that it was partnering with GlobalData Plc to carve out its healthcare division. The investment, worth £434 million, is being made by Inflexion’s minority equity strategy, Partnership Capital, with an overall enterprise value of £1.1 billion. Inflexion’s Partnership Capital Fund has a strong track record in leading corporate partnerships and carve-outs including the recently announced carve-out of aosphere with global law firm Allen & Overy.

It will be interesting to see how much deal activity in growth equity and corporate carve-outs/spin-offs there is in Europe over the course of 2024. One thing is certain: the evolving deal landscape will generate plenty of discussion among GPs and LPs in Cannes.

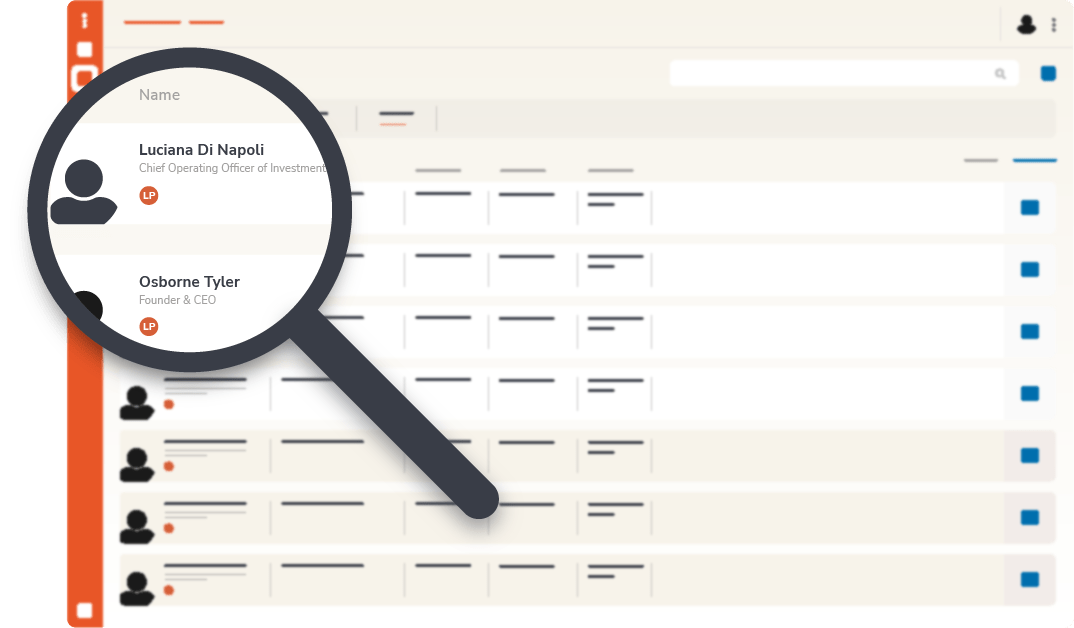

☑️ Maximize Your Networking Potential:

Tap into advanced tools for seamless connections. Use our innovative algorithm for perfect matches within the industry.

☑️ Unrivaled Event Preparation:

Plan meetings, access the participants’ list, and customize your agenda effortlessly.

☑️ Stay Informed, Stay Ahead:

Real-time updates, offline event program, and all info in one place.

☑️ Experience the Power of Collaboration:

Engage with the private equity community.

☑️ High-quality connections using our affinity algorithm.

☑️ Filter opportunities to minimize irrelevant solicitations.

☑️ Manage communications with our secure email system.

☑️ Access exclusive reports, replays, photos…

☑️ Maximize your event experience.

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.