IPEM Paris 2023 – The Daily Spin – September, 20th

IPEM Paris 2023 – The Daily Spin, September 20th

Are private markets destined to outperform? That will be the $64,000 question.

At IPEM Paris 2023, on September 18-20, delegates will have a perfect opportunity to hear the views and opinions of some of the world’s leading GPs and LPs, on how the industry will seek to adapt its performance parameters in a world of rising geopolitical tensions and higher interest rates. Factor in artificial intelligence rising to prominence and climate risks pushing the mercury higher, and it certainly feels like a markedly different world to the previous decade.

As GPs evaluate the deal landscape and the future prospects of value creation, with sustainability becoming an increasingly important factor, some degree of recalibration will be needed to ensure their strategy approach remains robust. And well suited to deliver continued performance in an ever-changing world. Not that this will be easy. With record levels of dry power – an estimated 3.7 trillion dollars at the end of 2022 – competition to do deals at optimal entry points is intensifying.

Rise to the challenge

A recent report by Hamilton Lane shows that last year, while 40% of companies listed on the Russell 2000 index had negative earnings, for private companies it was only 8% through Q3 2022. They also point out that operational improvement and good governance have helped exit multiples remain robust.

What might performance look like in the next five years for funds that launched in 2020 and 2021, especially those that invested in healthcare and technology at the peak of valuations before markets fell? History has shown that the best vintages tend to originate in more challenged markets. This is just one of those periods.

“Historically, funds that have launched in challenging markets have proven to be very good vintages; i.e. 2001 when the dot.com bubble burst and 2008 during the global financial crash,” comments Karsten Langer, Managing Partner, Riverside Europe, a PE group that focuses on the smaller end of the middle market.

“What is not being spoken about are the funds deployed in 2020 and 2021, when technology and healthcare valuations were very high. What might the performance of those vintages look like in five to 10 years’ time?”

When asked whether GPs should expect a slower fundraising cycle over the coming years, regardless of how good their previous fund performance has been, Langer suggests: “This year could be the first time that total AUM for private equity does not experience year-on-year growth.”

Chosen specialist subject

One trend that BDO recently suggested was that in the current climate where lending, generally, has tightened, PE firms will sharpen their focus on bolt-on acquisitions, particularly in low-risk sectors such as life sciences.

This could lead to even more sector specialism within the industry as GPs apply a laser focus to identifying undervalued companies.

Private Equity International recently reported that niche strategies have outperformed generalists over the last decade, generating a 2.1x versus 1.8x multiple on invested capital.

Skilled PE firms who can work with management teams to expand into new markets and introduce digital transformation improvements, for example, will be able to accelerate value creation. Resilience is likely to be an important feature of the investment landscape: can companies expand their profit margins even when markets are challenged?

Elin Ljung, Managing Director – Head of Communications & Sustainability, Nordic Capital, believes the most successful funds “will be those that take a specialist approach, understanding specific segments within their selected sectors and applying genuine operational expertise”.

“At a time of budgetary pressure, businesses that can increase efficiency and cost savings will be at a premium,” she says. “This is why digitalization is often an important part of the value creation journey for our companies. Many businesses will come out of the current conditions leaner, with a more efficient structure and strong digital tools at their disposal.”

One might also see hyper-specialisation, as GPs apply their expertise to develop even more focused strategies. Industries such as clean energy, food technology, biotechnology, and AI/cybersecurity are just some examples of where hyper-specialists might look to assert themselves.

Sector specialists have delivered strong performance over the years “and the current economic environment represents a good opportunity to pick out the best companies, and help accelerate their growth; for example through digital transformation,” says Langer.

“Management teams want reassurances that you understand their industry and that you have the expertise to effect change.”

Inertia creeps

Tech buyouts have not been as prevalent in 2023 compared to last year, during which private equity accounted for seven of the 10 largest information technology M&A deals in North America; the most notable being Vista Equity-owned TIBCO Software’s $16.5 billion merger with Citrix Systems in January 2022.

Although deal activity has been muted, 2023 has seen some notable deals such as Silver Lake’s $12.5 billion all-cash acquisition of Qualtrics, which it completed this March with co-investment partner, CPP Investments. According to PwC, although it only accounted for 10% of deal activity in Q1 2023, private equity represented more than 60% of deal value.

The buyout space is contending with a slower pace of fundraising and deal activity, broadly speaking, but there have been some bright spots. One only has to refer to CVC Capital’s latest fund (“Fund IX”), which closed with €26 billion to make it the world’s biggest ever buyout fund, to appreciate that large-cap PE groups continue to grow from strength to strength. Last year was a tale of two cities for buyouts with strong deal momentum from 2021 continuing for the first six months before slowing.

Deal inertia within the PE space has continued to creep in during 2023. The fact that investment into infrastructure and natural resources last year reached a new high of $158 billion, according to McKinsey, is a sign that private equity cannot rest on its laurels.

This is especially so given the growth trajectory in private credit, which now provides financing to an estimated 80% of middle-market PE deals. Meanwhile, big names like Oaktree Capital Management are launching multi-billion dollar funds to finance LBOs at the top end of the market. In terms of performance, private debt funds generated annualized returns of 5.3% through Q3 2022, according to Pitchbook.

Transition vamp

One of the topics on Day 1 (19th September) of IPEM Paris 2023 will cover whether now is the time for sustainability to prove it can deliver returns.

Abris Capital Partners is just one of many European managers with the conviction that portfolio companies that lead in ESG integration will deliver better long-term returns for private equity firms and their investors.

“Indeed, there is growing evidence to support this, with a recent paper from London Business School showing that increases in ESG disclosure were associated with a 4.9% increase in the net IRR of a fund,” says Pawel Gierynski, Managing Partner at Abris. “As an ESG transformation specialist, Abris has embedded carbon transformation into its portfolio value creation process. Our flagship Climate Manifesto program is already making our companies more attractive assets for potential global buyers.”

The FCA has suggested three potential consumer labels for green funds under its Sustainable Disclosure Requirements: sustainable focus, sustainable improvers, and sustainable impact.

The “sustainable improvers” label could help accelerate what is referred to as transition funds, as it will allow PE managers to invest in companies transitioning to net zero, thus removing the need to stipulate clear sustainable objectives.

“Despite the challenging market conditions we believe that private equity has a critical role to play in building a sustainable world and driving change within business to benefit society and the planet. This will continue to be an important strategy element in the year ahead,” concludes Ljung.

As private market practitioners weigh up the opportunities and challenges that face them in today’s uncertain world, IPEM Paris 2023 will seek to answer key questions on how best to prepare for future performance.

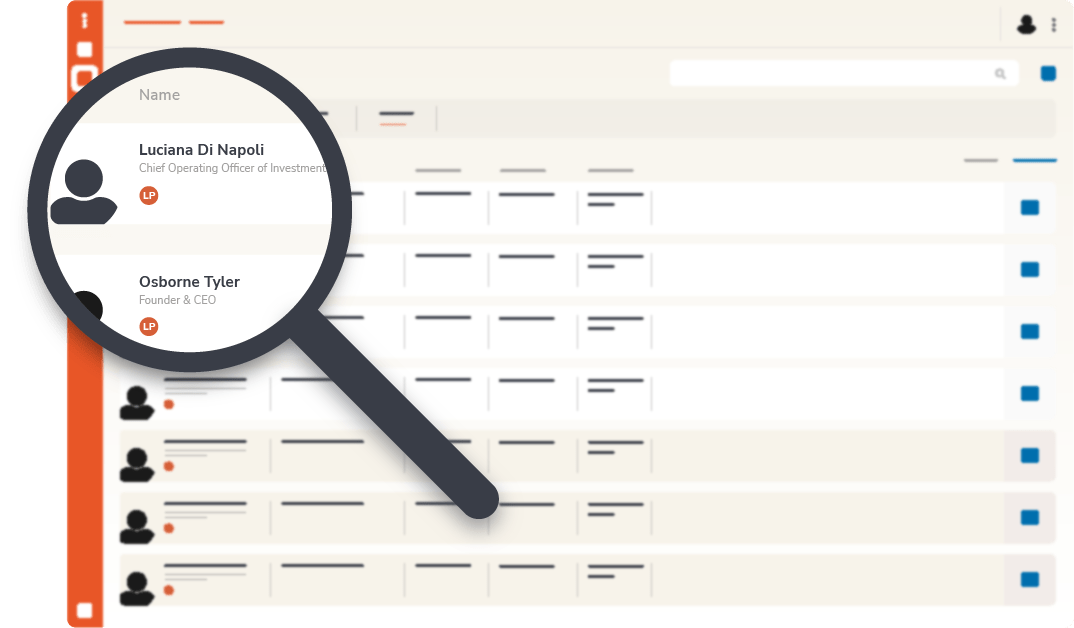

☑️ Maximize Your Networking Potential:

Tap into advanced tools for seamless connections. Use our innovative algorithm for perfect matches within the industry.

☑️ Unrivaled Event Preparation:

Plan meetings, access the participants’ list, and customize your agenda effortlessly.

☑️ Stay Informed, Stay Ahead:

Real-time updates, offline event program, and all info in one place.

☑️ Experience the Power of Collaboration:

Engage with the private equity community.

☑️ High-quality connections using our affinity algorithm.

☑️ Filter opportunities to minimize irrelevant solicitations.

☑️ Manage communications with our secure email system.

☑️ Access exclusive reports, replays, photos…

☑️ Maximize your event experience.

IPEM Paris 2023 – The Daily Spin, September 20th

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.