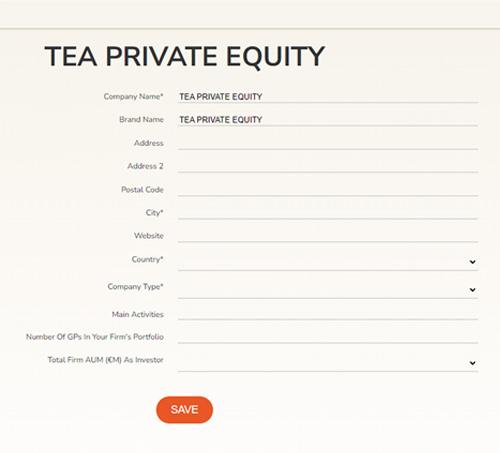

1. THE ONBOARDING PROCESS

In order to benefit from all that IPEM has to offer, one of the steps you must take is the onboarding process. During this process, we will ask you several questions about your firm. Your answers will give us a clear view of your activity and allow us to provide you with a tailored experience that fits your exact needs.

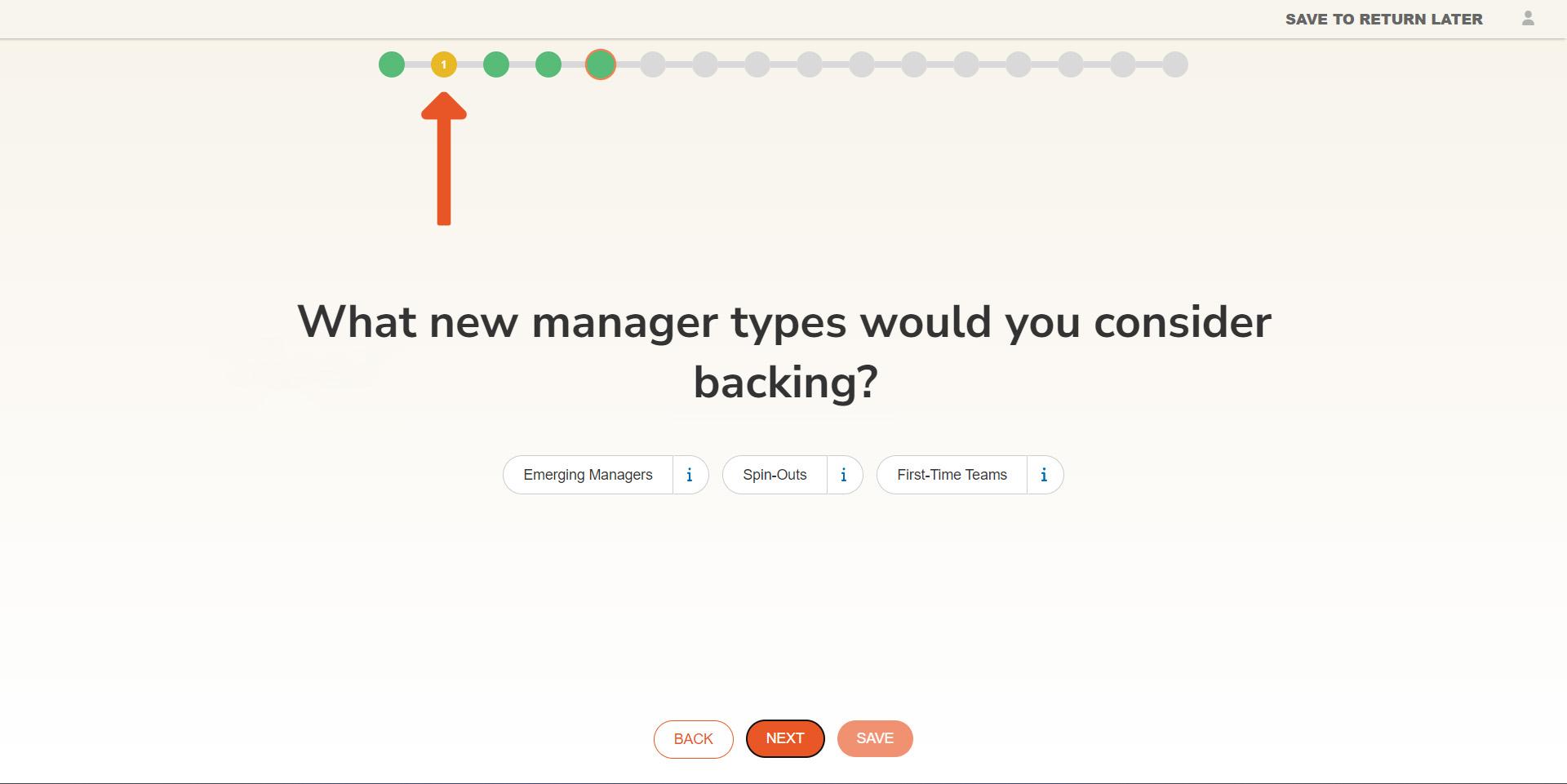

If you advance without answering one of the required questions, you will get a red error message, and a yellow circle will appear on the timeline at the top of the screen, revealing where it is. If you don’t have all the information, you can click on SAVE TO RETURN LATER and come back to finish the onboarding process.

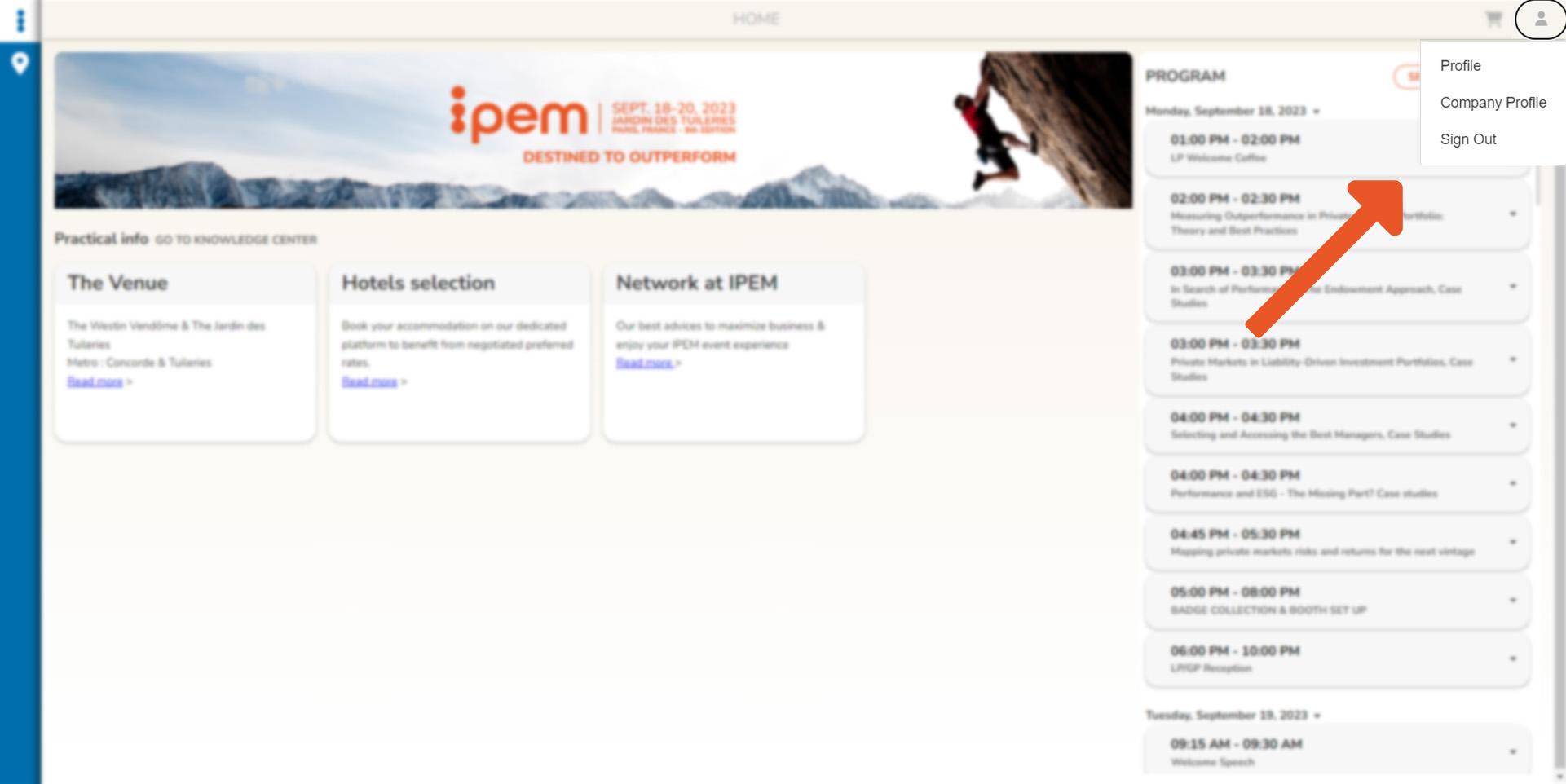

After you’ve registered and completed your onboarding process, you will arrive at your account’s homepage. Total access to all IPEM features depends on an internal activation by the IPEM team once your information has been reviewed.

2. PROFILE COMPLETION | Fund Managers

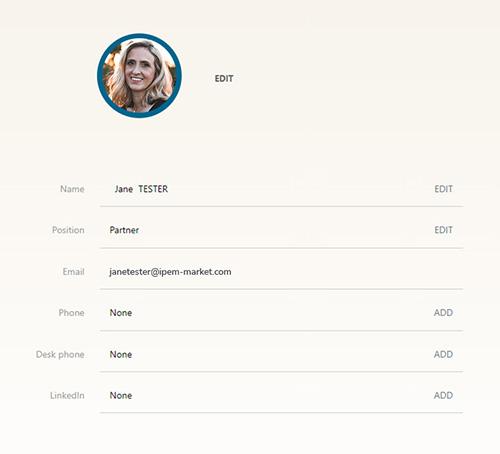

a. Personal Information: Accurate personal information, including your full name, contact details, and professional title.

b. Biography: Craft a compelling and concise biography that highlights your professional background, investment strategy, and notable achievements.

c. Fund Details: Information about your fund, such as its name, size, strategy, and target sectors/geographies. Providing clear and concise details will help LPs assess your fund’s alignment with their investment criteria.

d. Track Record: Add information about your past investments and exits. Include key metrics, such as fund performance and notable portfolio companies.

e. Team Members: Highlight the members of your team, their roles, and relevant experience. This demonstrates the collective expertise of your fund’s management team.

f. Media and Documents: Upload supporting documents, such as fund presentations, pitch decks, and media coverage, to enhance credibility and visibility.

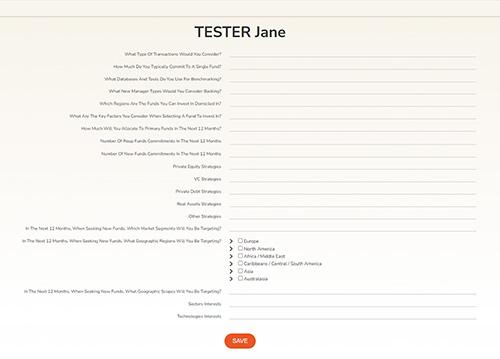

3. PROFILE COMPLETION | For LPs

a. Personal information: Provide accurate personal information, including your full name, contact details, and professional title.

b. Investment preferences and plans: Specify your investment preferences, including sectors, geographic focus, fund size, and manager seniority.

c. Media and documents: Upload any relevant media coverage or documents that showcase your expertise or investment history.

4. PROFILE COMPLETION | Advisors & Business

a. Personal information: Provide accurate personal information, including your full name, contact details, and professional title.

b. Service offerings: Clearly define the services you offer, such as financial advisory, legal expertise, marketing, or other relevant services.

c. Expertise and experience: Highlight your professional expertise and experience, emphasizing any notable achievements, industry recognition, or certifications.

d. Client testimonials: If available, include testimonials from satisfied clients to build trust and credibility.

Did you find the answer to your question?

If not, do not hesitate to use our contact form for support.