Bird’s eye view

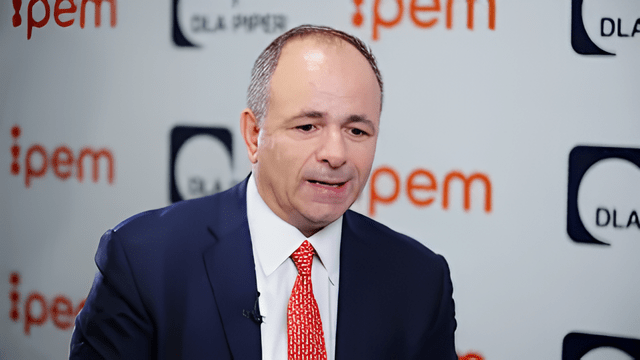

The wisest investors know where to spot the best opportunities irrespective of charging market conditions. And it that sense, Blue Owl Capital is no exception. Despite expectations that the US will see interest rate cuts this year, the firm’s co-chief executive, Marc Lipschultz, still expects private credit to enjoy strong demand. Given the floating rate nature of private lending, any rate cuts will likely see adjustments to expected returns, but the spreads on offer will still catch the eye of investors. And with over $200 billion raised in private credit funds last year, there is plenty of capital for managers to use, and swoop in on PE-backed companies seeking out alternative financing options. Rate cuts are inevitable. But private credit is still capable of soaring higher.