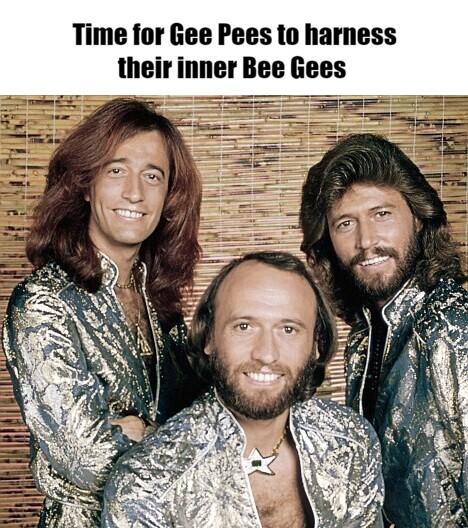

Staying Alive, Staying Alive

Private equity firms are having to channel their inner Bee Gee by injecting more equity into portfolio companies to ensure they are ‘staying alive, staying alive.’ Bank and private credit lenders are looking for more skin in the game from PE sponsors when it comes to refinancing and extend loans in the current high-interest rate environment. The net effect is to lower the gearing in portfolio companies; something that buyout firms have traditionally eschewed as they look to maximize the IRR of their funds. This new verse in the buyout debt musical increases sponsor risk, given the additional equity they are having to commit. Whether they will still be singing from the rooftops in years to come will depend on how effective their deal-making is, and their ability to innovate debt-to-equity commitments.