IP..Oh..No!

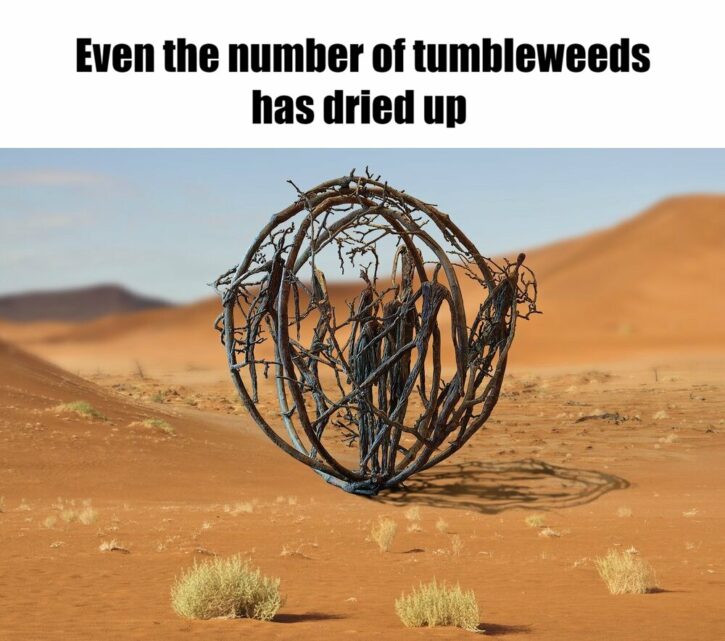

The PE exit landscape has entered a barren phase this year with fewer than 900 completed exits in the US through September. EQT’s CEO Christian Sinding has referred to dysfunction in the IPO markets, prompting the firm to consider private stock sales to give LPs some liquidity back. It’s another sign of GPs thinking creatively to free up capital. Think of it more as an appetizing starter before LPs are given the main course – that is, when a full exit is achieved. GPs will be privately watching on the sidelines to see if this route is worthy of exploring. With other choices on the table – namely continuation funds and NAV financing – the menu of liquidity options is starting to expand. All the while demonstrating the further evolution of the PE marketplace.