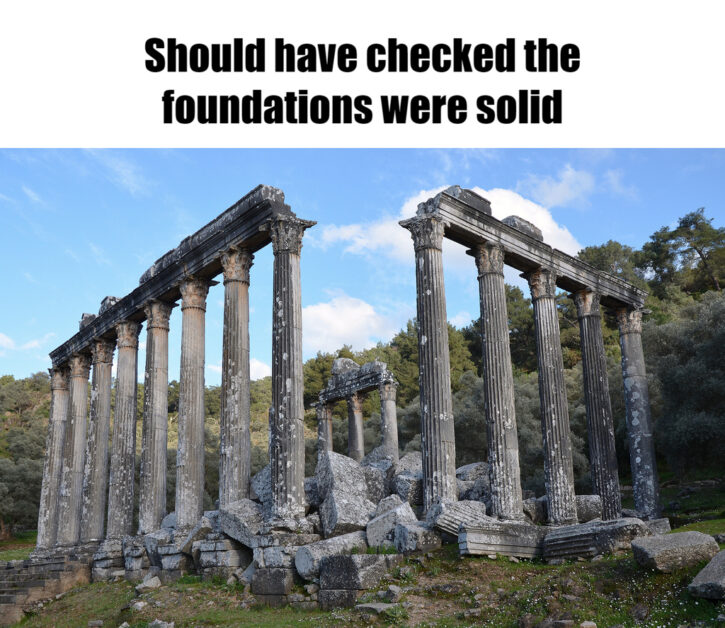

Temple of boom

The era of cheap money has helped private debt balloon to $1.5 trillion but the temple of private debt could face a number of sacrifices in the coming period.Oaktree Capital Management co-founder Howard Marks has voiced concerns that high interest rates and slowing economic growth could test portfolios that were built in previous years when it seemed every private debt lender was worshipping in the same temple. But a more challenging macro environment is eating in to profit margins, placing significantly more stress on some portfolios. Marks, however, is bullish on the outlook and sees this as a good climate to be exploring new opportunities, with higher interest rates offering attractive returns for those wishing to venture further into direct lending space as US banks continue to retrench. For now, fund managers might well be praying that they avoid corporate defaults in their existing fund vintages.